On Wednesday the Chancellor George Osborne published what was unsurprisingly a highly politicised budget.

With the election looming, increases in the personal tax allowance, deposit top-ups for first-time home buyers and tax cuts for savers symbolised the UK’s economic recovery: we are entering a new period, contended Osborne, with living standards rising to pre-crisis levels. To counter the narrative of ideologically motivated state shrinkage, the Chancellor also scaled back his deficit reduction plans: predicting a £7bn surplus by 2019-20, rather than the £23bn originally planned for.

But the Office of Budget Responsibility’s Economic and Fiscal Outlook (March 2015) quickly revealed the scale of public spending cuts in the next few years that would result from the budget, and provided some important insights into the nature of the economic recovery. The report suggests a ‘rollercoaster profile for implied public services spending’ with the squeeze on real spending in 2016-17 and 2017-18 being sharper than at any time in the past few years, before rising to the highest level since the beginning of the current administration by 2019-20. The Chancellor was unusually quiet on the NHS, while non-protected Government departments face £13bn worth of cuts (not to mention a further £12bn of welfare cuts). It is unclear how much of this local government will bear, but the impact is likely to be significant, especially in adult social care, which has not been ring-fenced despite calls for it to be protected, and the likelihood that local authorities will have to begin making significant cuts to spending on statutory services. On Thursday the Institute for Fiscal Studies asked the Chancellor to provide more detail on where the £12bn of welfare cuts will fall, while also underscoring that welfare changes under the current administration have hit the poorest hardest. It added that the pickup in living standards was the slowest in history and “no cause for celebration.”

The OBR report shows that stronger growth forecasts also appear not to be linked to a successful economic strategy, but to the impact of lower oil prices and the resulting lower inflation levels on real incomes and consumer spending. Despite employment levels continuing to rise, and potential output growth and future tax receipts helped by net migration rises, the tax base has also failed to keep up with GDP growth, partly as a result of employment growth coming from low wage and part-time jobs, including a sharp rise in low-paid self-employment. A low-wage economy is adversely impacting the state of public finances.

In short, our economic model and approach to public service spending continue to be deeply flawed. And unsurprisingly, it is the worst off that bear the burden. By the end of the next financial year, local authorities will have lost 40 per cent of their core funding from central government through the course of this Parliament. The impact on communities, especially the poor, is immense.

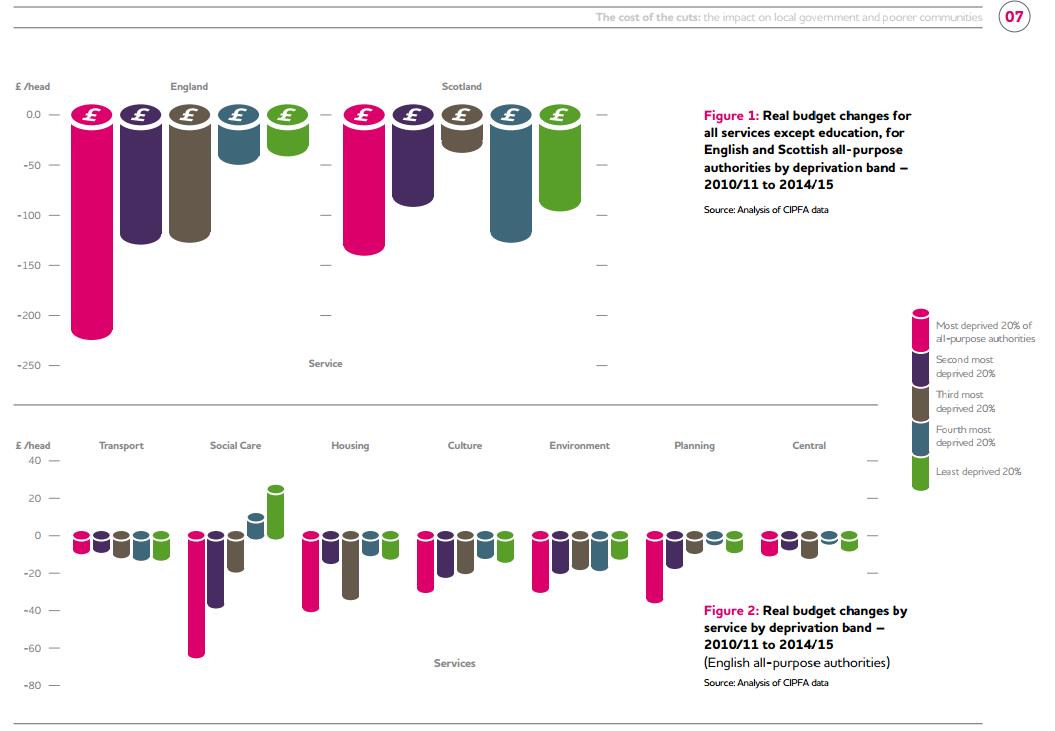

Last week the Joseph Rowntree Foundation (JRF) published the most-up-to-date picture of the impact of cuts to council services. Unsurprisingly, poorer communities and residents have been hardest hit by service reductions. In adult social care, real spending has fallen by £65 per head (14%) in the most deprived communities, while increasing by £28 per head (8%) in the least deprived. Despite having significantly higher levels of social need, the difference in funding levels between councils with deprived communities and those with better-off residents is closing. In England, as the report highlights, ‘there has been a striking convergence in the levels of funding between more and less deprived local authorities.’ This is not just postcode lotteries on overdrive: it is the upwards redistribution of public money away from the poor and towards the better off.

The JRF report highlights how local authorities are responding innovatively to the cuts, for example through achieving efficiencies and shifting to an investment approach to reduce long-term need, but warns that they will not cope with further cuts. Public service reform and innovation requires appropriate levels of funding.

But what does this mean in a country where many people still see austerity as a credible political and economic strategy, despite monumental rises in demand for services? In the immediate and medium term there must be a loosening of austerity. Ensuring decent public services and protecting the poorest communities should be more important priorities than achieving a budget surplus in five years’ time. There should also be far greater effort in achieving an economic recovery that benefits all sections of society and isn’t defined by low wage employment growth. The result could be a stronger economy, a better off population and more tax revenues to invest through public spending. As the OECD recently suggested, reducing income inequality boosts economic growth. Creating a fairer and more equal society and economy could create a virtuous cycle of strong economic growth and high levels of welfare and wellbeing.

But in the longer term something far more radical is needed. In public services this may mean a far bolder agenda for devolution, so that services and economic strategies are truly integrated around the needs of local communities across the country. On the part of citizens it may require a shift in attitudes towards public spending, including a greater appreciation that higher taxes (in the context of progressive taxation) combined with genuine efforts to reshape the economy can simultaneously create economic growth and achieve key social goals such as greater economic equality and better health and welfare. For society it could mean a greater willingness to explore radically different approaches to welfare, such as a citizen’s income, which address the inequities of the current system of means-tested support as well as the associated stigma for recipients – and perhaps most fundamentally, enable the emergence of a radically new welfare state that truly empowers citizens.

Related articles

-

Nine famous female Fellows inspiring inclusion

Dean Samways

International Women’s Day 2024 invites us to imagine a world where all genders enjoy equality. Where prejudice and discrimination no longer exist. This is the world our work is helping deliver to this and future generations.

-

Fellows Festival 2024: changemaking for the future

Mike Thatcher

The 2024 Fellows Festival was the biggest and boldest so far, with a diverse range of high-profile speakers offering remarkable stories of courageous acts to make the world a better place.

-

Inspired by nature

Rebecca Ford Alessandra Tombazzi Penny Hay

Our Playful green planet team summarises a ‘lunch and learn’ at RSA House that focused on how the influence of nature can benefit a child’s development.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.