It’s the middle of the political party conference season in the UK. Jeremy Corbyn has just been re-elected Labour Party leader, much to the chagrin of a majority of his MPs and the bewilderment of many Labour supporters. Prepare for round two in Labour’s battle for its own identity, let alone its return to government.

Next week it will be the turn of the Conservative Party where Theresa May will address conference as leader for the first time. Close supporters of David Cameron and George Osborne are expected to give the conference a wide berth. It is likely that recent speculation that Theresa May went ‘soft’ of immigration as Home Secretary was designed to chuck a few banana skins onto the path of the new PM’s ascent. The Notting Hill set aren’t going down without a token fight.

In the US, with five weeks to go until the Presidential election on 8th November, the polls are tight and the rhetoric dangerously divisive. In Europe, the migration crisis has cleaved a space that far right parties have been quick to occupy. In recent elections in Germany, for example, the Alternative für Deutschland party, founded in April 2013, gained representation in ten of the 16 German Länder. Developed countries across the world are experiencing seismic shifts in their national politics from the left and right; Brexit is just the tip of the iceberg.

At the root of this phenomenon is an emerging consensus that the global economy is failing to benefit whole sections of the global population. Not just in the poorest countries of the world, but in the most developed economies. Addressing the UN Assembly last week, President Obama warned of ‘soulless capitalism’ alienating people from the economy and society. Theresa May also called on the UN and international institutions to better represent people affected by globalisation, citing disaffection with politics as one reason why the UK voted for Brexit.

But things might just be about to get a whole lot worse. The era of low growth that has characterised the global economy since the financial crisis in 2007/08, with stagnating productivity and downward pressure on real wages and living standards, is itself under threat as protectionism marches into the political mainstream. As Martin Wolf has argued recently in the FT, “Globalisation is no longer driving world growth,” the impact of which could reverse the huge inroads it has made on global income inequality over recent decades (between 1980 and 2015 average global income rose by 120 per cent).

Similarly, the OECD has warned of impact of persistent low-growth, calling on governments to focus on social investment in health, education and childcare subsidies that can boost economic growth and ensure the benefits of globalisation are more equally shared, particularly within high-income economies.

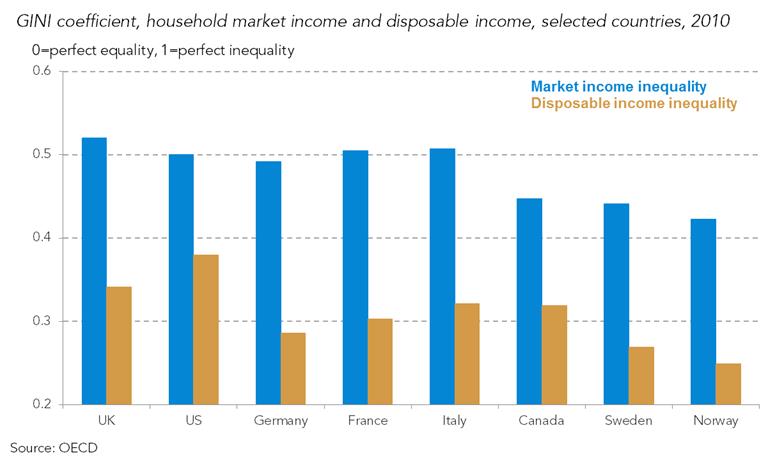

In the UK our investment in public services and fiscal redistribution makes an important contribution to smoothing the impact of market income inequality:

The last few years of austerity have put enormous strain on the system, with many low-middle income households feeling the effect. If government is serious about making an economy ‘work for everyone’, it needs to set a threshold test for domestic policy. Do the new industrial strategies, for example, impact positively on the lowest paid and the poorest communities? Will new education strategies really start to alleviate entrenched inequalities? How might investment in social infrastructure – such as childcare, early years or work-based learning provision – be a greater source of sustainable, inclusive growth over the long term than alternative national or local projects?

Last week the RSA’s Inclusive Growth Commission set out its framework for what this should entail in its interim report, overturning long-held assumptions that the ‘rising tide’ of prosperity will ‘lift all boats’. Decades of persistent poverty and inequalities within and between places of the UK show this is palpably not the case. In our cities, towns and neighbourhoods across the country the costs of failed economic systems and social policy are played out. London illustrates the prosperity paradox where runaway growth is accompanied, if not sustained, by poverty and inequality.

Yet it is the level of place where there is the potential to respond most effectively to the challenges of globalisation and inclusive growth. As Bruce Katz, Benjamin Barber, Richard Florida, Ed Glaeser and countless others (including our own City Growth Commission) have argued, local place-based leadership brings energy, knowledge and political connectivity to citizens in ways that national governments cannot.

Increasingly we’re seeing city leaders in the UK step up to the plate. Whether it’s Sadiq Khan, Mayor of London in talks with Bill de Blasio, Mayor of New York, about tackling the rise of extremism, or Marvin Rees, Mayor of Bristol, working through the new Global Parliament of Mayors, local leaders are coming to fore. They might be more constrained in their hard powers, such as revenue-raising ability, but they are being buoyed by the early stages of devolution. If government really understands the need to reengage citizens in politics highlighted by Brexit, it should be seeking to establish city leaders as part of the building blocks of central government.

The independent Infrastructure Commission, for example, is a noble (but ill-fated) attempt to depoliticise physical infrastructure decision making for projects such as High Speed rail. But if we are to achieve a national economy that works for everyone, we need to create a system of thriving cities and towns and involve their leaders in long term investment and policy decision making. As we argue in the Inclusive Growth Commission’s interim report, this would be just one aspect of a more grown up approach to devolution – moving beyond the binary ‘devolve’ or ‘centralise’ that has characterised the process so far, and to bring together the best of each.

Then it is a matter of putting sufficient resource in the hands of city leaders with appropriate flexibilities to maximise the totality of public spend within their locality over the medium to long term. As several Labour figures were quick to point out at the Inclusive Growth Commission’s event at conference this week, we’ve been here before in nascent form via Total Place. By now we’d have over 6 years of data on what works to align economic and social policy and spending at a local level, the positive impact that this can have and the short term costs that might be incurred by actively targeting a more inclusive approach to growth over the longer term. In reality, will places proactively avoid all or any local growth based on low-quality jobs in pursuit of more sustainable opportunities for local people? There will be tough choices ahead, but local leaders - who can involve people in their decision making and be accountable for results – will be best placed to make these.

After another fringe event in Birmingham and whistle-stop trip to Washington DC next week, the Commission will look to consider the scale of devolved investment needed in the UK and how this might be achieved through any kind of fiscal ‘reset’ we might hope to see at the Autumn Statement.

In making the case to HM Treasury and an increasingly powerful No.10 Downing Street, the influence of the private sector in general and financial services industry in particular should be a powerful driver of change. Speaking to the Today Programme about the impact of Brexit, Larry Fink, Chief Executive of Blackrock (a private investment firm with £5 trillion under management) said: “I think there is a lot of concern about Brexit…and is this is a signal to the rest of the world that they’re not playing close enough attention to the general population…is there a message that’s being sent?” If Fink, Christine Lagarde, Managing Director of the IMF, and our own Stephanie Flanders, JP Morgan Chief Strategist (Britain and Europe) and others in the financial sector are warning of the urgent need for reform it’s time to pay attention. Though, of course, the financial sector does have a knack of externalising these challenges – contribution should perhaps begin closer to home. Nonetheless, the point is a good one.

The last word I give to a local leader, Marvin Rees. Speaking at the Core Cities Business Summit last week, the Mayor of Bristol reminded us – in response to the Commission’s interim report – to consider not only what is the benefit of inclusive growth, but also what is the cost of bad growth? The UK has been good at globalising in the past. The challenge is now to make globalisation work for all.

Read the Inclusive Growth Commission's interim report

Find out more about the RSA Inclusive Growth Commission

Charlotte Alldritt is Director of Public Services and Communities. Previously, Charlotte ran the RSA City Growth Commission, an influential inquiry into how city-regions can drive UK growth. Before joining the RSA, Charlotte was a Senior Policy Advisor to the Deputy Prime Minister working on immigration, energy and housing.Charlotte's personal interest is in accountability in public services; she directs the Open Public Service Network (OPSN).

Be the first to write a comment

Please login to post a comment or reply.

Don't have an account? Click here to register.