Political shocks are casting a large shadow over the UK’s financial industry. President-elect Trump is currently dominating the headlines, but June’s vote for Brexit is a far greater source of uncertainty. Economic forecasts are contradictory. Markets are twitchy. Above all, the future shape of regulation - the rules of the game for modern finance - has been thrown into doubt.

Political shocks are casting a large shadow over the UK’s financial industry. President-elect Trump is currently dominating the headlines, but June’s vote for Brexit is a far greater source of uncertainty. Economic forecasts are contradictory. Markets are twitchy. Above all, the future shape of regulation - the rules of the game for modern finance - has been thrown into doubt.

Financial firms are responding as they always do to external shocks. Contingency planning is underway, strategic reviews are gathering steam, lobbying has begun and investments are being put on hold.

The Leave vote – and the Trump victory - may appear to be unique events, but they are only the latest in a decade-long series of dramas to hit the financial industry. Furthermore, the coming decade seems likely to be more volatile than the last. Divisive US politics, European fracture, chaos in the Middle East and the clash of states in East Asia all point to an unstable macro outlook. The global economy remains highly unbalanced. Unconventional monetary stimuli are having unpredictable effects. And the UK government, like many others, is embracing a schizoid blend of globalism and protectionism.

In short, ‘Leave’ and other disruptive events are reinforcing the strategic and operational problems that financial institutions have been facing for several years. Banks are too complex for managers or investors to fully understand; post-Leave, the need for additional subsidiaries will make them more opaque. Asset managers are struggling to consistently beat the market; post-Leave, they will face greater criticism for failing to protect investors. Life insurers are trying to reconcile the needs of policyholders with those of shareholders; post-Leave, loose monetary policy will make balance sheet management even harder.

Of course, many of these upheavals can be traced back to past actions of the financial sector. But volatility is making it hard for firms to make much-needed progress on conduct, culture and customer outcomes. It is not in anyone’s interest for the industry to be permanently off-balance.

So how should financial firms respond? First, they must avoid viewing Brexit and other shocks as temporary problems. Second, they need to develop a strategic response to volatility. That means embracing unpredictability and putting it at the heart of their business.

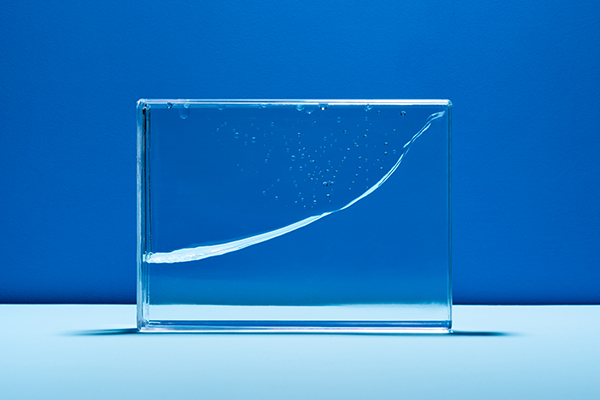

Traditionally, finance has aimed to protect customers from instability. Protection is at the heart of the mutualised model once embraced by many British banks and insurers. And the ability to smooth financial costs – by spreading risks across a population, or investments over a lifetime – remains central to modern retail finance. But institutions today can no more protect themselves or their clients from volatility than politicians can protect voters from events beyond their borders. Firms need to adapt their methods to a world of continuous unpredictability. That not only means helping clients to manage instability, but enabling them to feel comfortable about living with it.

How is this to be achieved? Accessibility and support are clearly part of the picture. Younger customers expect digital universality, and firms are already investing heavily to revolutionise user experiences. Convenience is the watchword.

Convenience is all very well, and a welcome improvement. But greater ambition is required. It is not only geo-politics that is growing more unpredictable; so too are consumers’ financial lives. The industry needs to use new technology and techniques to develop infrastructures that are not merely accessible, but flexible and portable. Movement, migration and temporary employment are becoming the norm, not just for low-skilled Generation X workers on zero hours contracts, but also for highly skilled tech-savvy Millennials. Financial adaptability will be crucial to the future happiness of young adults, those still in school and those yet to be born.

Unfortunately, delivering this sort of adaptability to the mass market presents huge challenges. For banks and insurers, the greatest problem lies in balance sheet management. To use a personal loan as an example, a bank providing much more flexible credit terms to a borrower would need an equivalent increase in the flexibility of funding on the liability side of its balance sheet. Under current regulations, it would also be required to hold additional capital against this ‘riskier’ loan. The resulting increase in balance sheet liquidity and solvency would both depress profitability. That is not something that banks – most of which are currently struggling to generate an economic profit – can easily afford.

In the short term, this means that challenger banks, challenger insurers and FinTech providers are best placed to push innovation forward. But achieving a nationwide improvement in financial adaptability will require more than the support of start-ups. Incumbent institutions will need to change their ways, and for that to happen the goalposts set by investors and regulators will need to shift.

That is more than financial firms can achieve alone, but it is far from impossible. Nearly ten years after the financial crisis, investors and regulators are becoming more open to radical thinking. Now is the time for a wide-ranging, truly imaginative debate about the kind of financial institutions that customers, investors and taxpayers will value in future.

Andrew Mills FRSA is an independent financial services analyst and director of Insight Financial Research

Related articles

-

No hidden charges: making pension costs transparent

Hari Mann David Pitt-Watson

Pension charges have long been hidden from customers. Hari Mann FRSA and David Pitt-Watson FRSA look back at the part the RSA has had to play in bringing about transparency and disclosure of costs.

-

Purposeful finance and the pandemic

David Pitt-Watson Hari Mann

David Pitt-Watson FRSA and Hari Mann FRSA set out why the finance industry needs to act urgently to support companies and individuals during the pandemic – and how it should build a better economy once it is over.

-

Can cash survive coronavirus?

Mark Hall

Getting your hands on money has never been so important, yet nobody wants to touch it. Mark Hall explores the urgent need for a more inclusive digital economy.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.