This week the RSA publishes a new report on pensions for the self-employed. It warns against false hopes in the form of alternative saving strategies like property, and argues that thousands will face poverty in old age unless the government takes action. Our main recommendation is to create a flat rate of tax relief, which would be more progressive and leave 75 percent of savers better off.

The missing millions

The rise of self-employment has been one of the most remarkable economic stories of the last decade. The number of people who work for themselves has grown by 40 percent since the turn of the century, today reaching 1 in 6 of the workforce.

Too often this growing band of self-starters have been depicted as precariats by default. Yet studies show the vast majority are happier working for themselves. Less than a fifth want to exit their business, and for half of these the reason is to retire.

But the self-employed do face more challenges than most – none greater than preparing for retirement. Having been excluded from auto enrolment, and with no employer to top up their pensions, the self-employed are often left with negligible pension pots in later life.

The government, pensions industry and think-tanks agree that something needs to give. But widespread disagreement remains over the best way forward. While some say auto enrolment should be extended to the self-employed, others say that pensions are ill-suited to this group of workers and ISAs should instead be promoted.

In partnership with Etsy, we have attempted to lift the lid on this debate and weigh up the arguments for different interventions. Here are our 5 key takeaways:

1. The self-employed are under-saving for their future – and not by a small margin

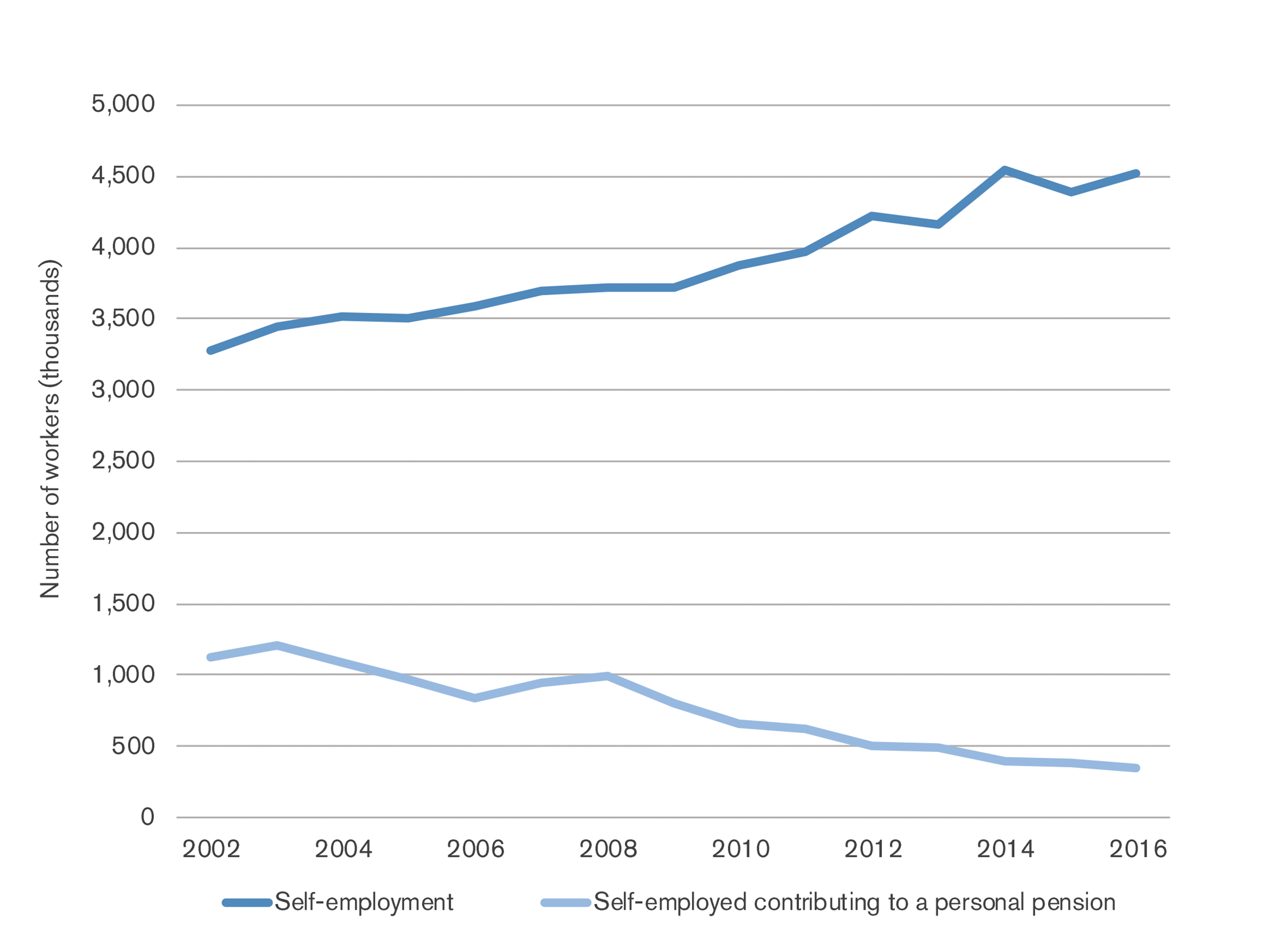

While the proportion of employees contributing to a personal pension rose by 51 percent in 2010/11 to 62 percent in 2015/16, participation among the self-employed actually fell from 23 percent to 17 percent.

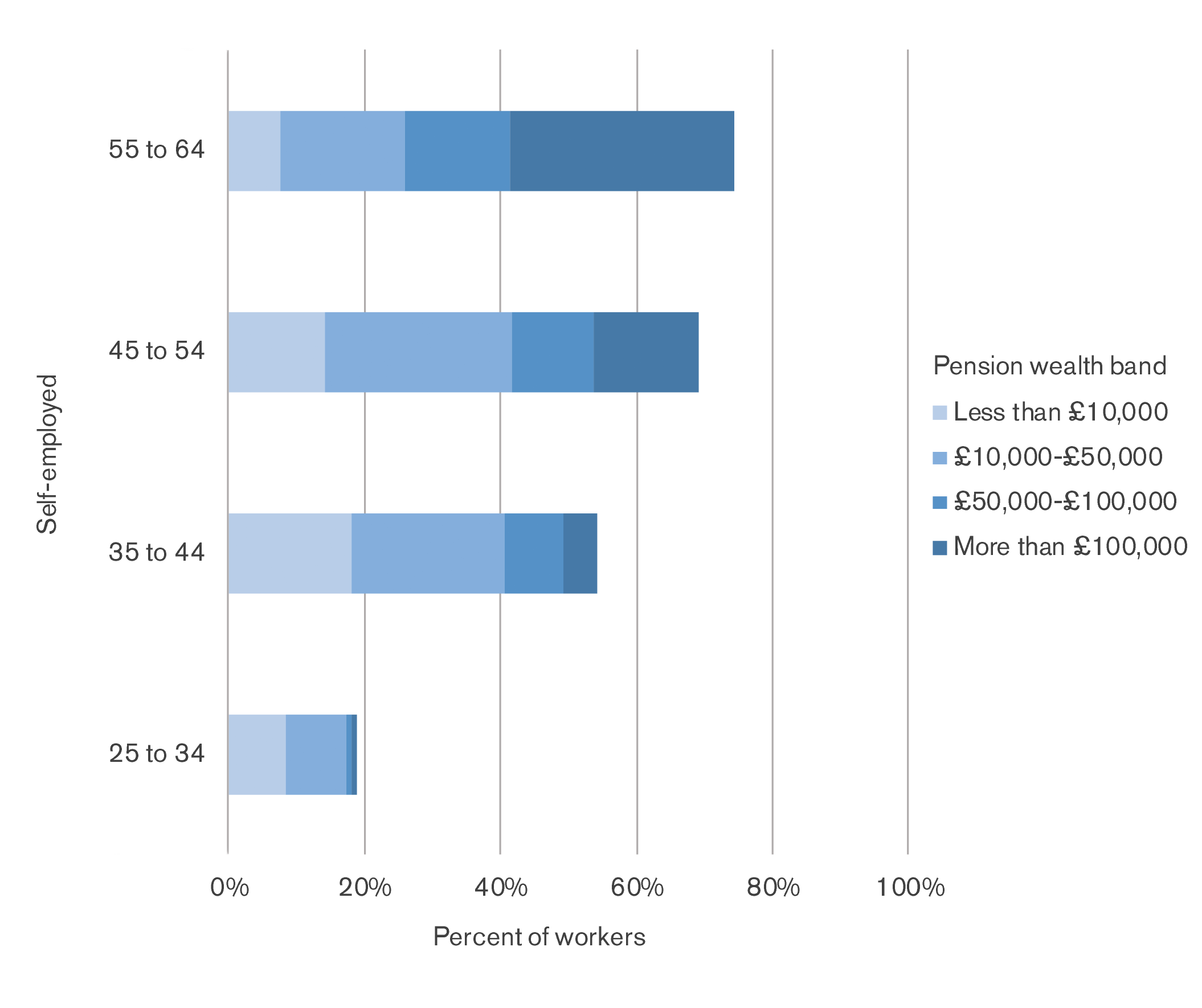

Even when the self-employed do save for the long-term, they tend to put away too little. Of those who are closest to the state retirement age (in the 55-64 year old age bracket), 26 percent have nothing at all saved in a personal pension.

What’s more, the self-employed appear to begin saving later in life, denying themselves the benefits of compound interest (what Einstein called the ‘eighth wonder of the world’). More than 80 percent of self-employed 25-34 year olds hold nothing in pension wealth – double the figure for salaried workers.

Low income workers, the ‘lifetime’ self-employed, and those will volatile incomes face the greatest obstacles to saving.

2. Alternative saving strategies such as property and partner income are a false hope

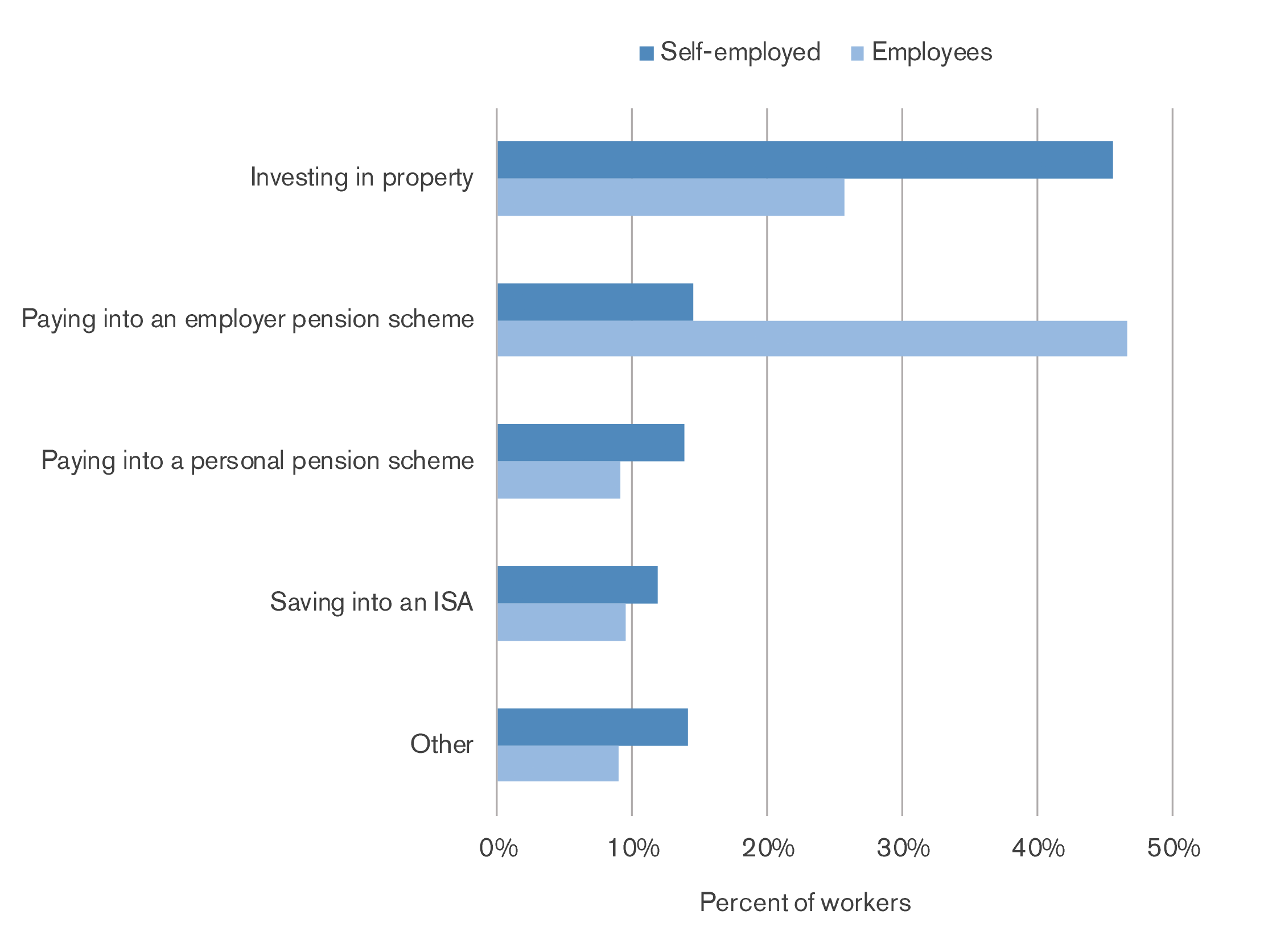

It is common to hear that the self-employed have made an active choice to avoid a pension, instead relying on other saving vehicles which they trust more.

One of these is property. But while it is true that the self-employed have a preference for bricks and mortar investments, this option is only available to those with the deposits to get on the housing ladder. Accessing the cash from property can also be troublesome. Downsizing depends on a healthy housing market, and equity release can be extraordinarily expensive.

Others may have pinned their hopes on selling business assets, such as machinery or equity in their firm. According to a survey by Aegon, 630,000 self-employed people view this as a financial lifeline. Yet the sums in consideration are usually very modest. Although 40 percent of the self-employed hold business assets, fewer than a fifth hold upwards of £20,000.

A third strategy is to rely on a partner’s nest egg. Here, the risks are more obvious. A 2013 study by the ONS estimated that 42 percent of marriages end in divorce, with more than half of these ending in the first ten years.

Overall, pensions remain the best long-term savings vehicle for most of the self-employed.

3. Auto enrolment is necessary but not sufficient to meet the savings shortfall

Among those who agree the self-employed should be saving more into pensions, the usual go-to solution is to bring them into the remit of auto enrolment. We agree, and would urge the government to redouble its efforts to find a technical solution to this challenge. One option, as has already been mooted, is to create a new duty for accountancy software providers to enrol their self-employed clients onto a pension.

Yet auto enrolment on its own is insufficient. The challenge is not just to enable the self-employed to begin saving, but to save enough, and to access those savings responsibly both before and after the point of retirement.

Using this wider lens brings into view a broader set of potential interventions. One of these is to turn the new Pensions Dashboard into a comprehensive Money Dashboard, allowing people to see the full state of their finances and make better saving decisions as a result. Another is to pilot a ‘Sidecar Pension’ model, which combines a rainy day fund with a pensions account, thereby giving self-employed savers greater liquidity without undermining long term savings.

4. Indirect measures like smoothing cash flow could spur pension contributions

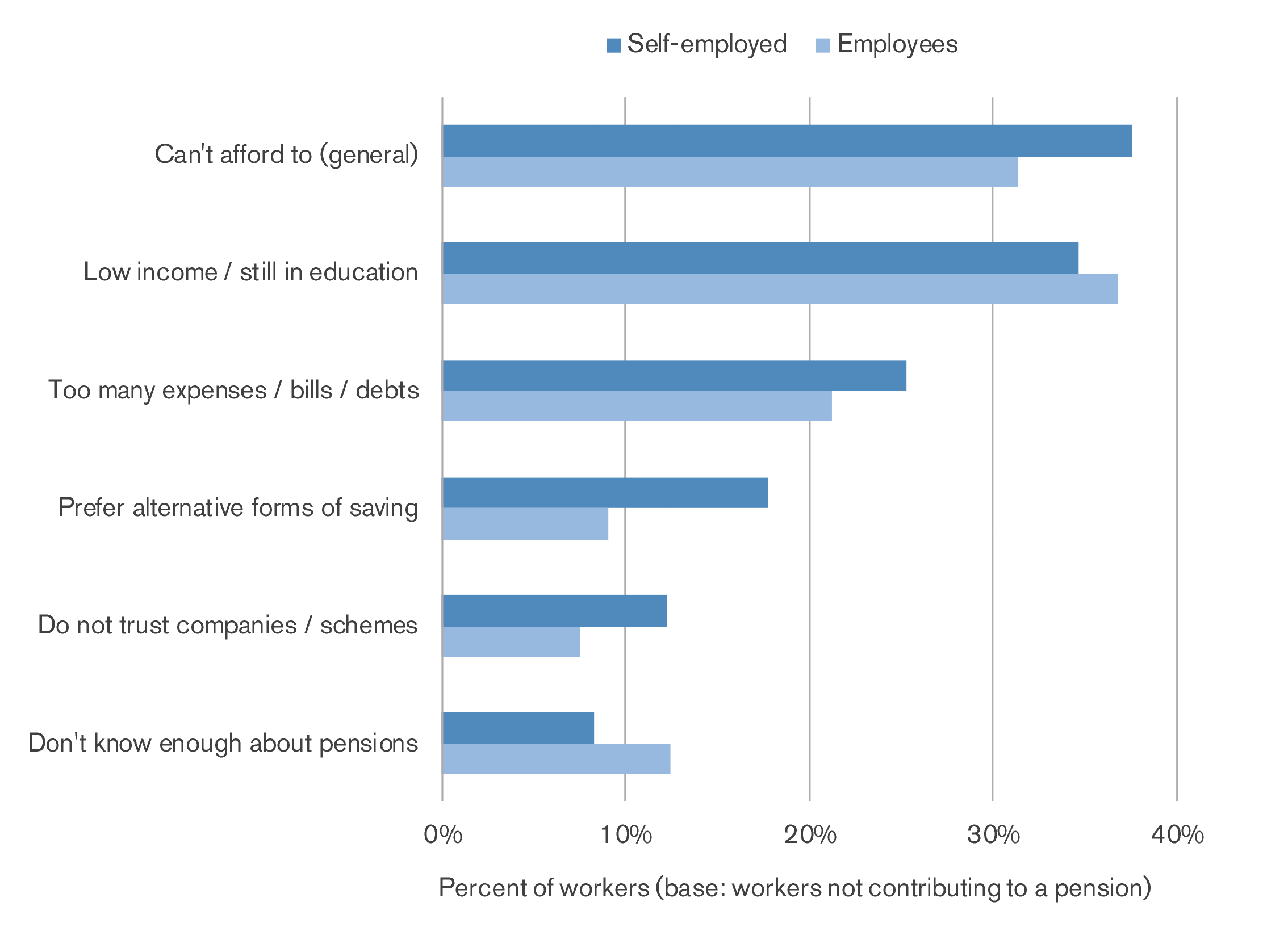

Attempts to spur greater saving among the self-employed should recognise the underlying reasons they fail to save in the first place.

Volatility in income is a major hurdle. Taxi drivers can never be sure how many fares they will have from one day to the next, just as plumbers and electricians are blind to how many call outs they will receive in a week. Income is thus characterised by feast and famine, making it difficult to know how much can be put away for the long term.

Market turbulence is beyond any single person’s control. But measures can be taken to make income more predictable, for example helping the self-employed cope with ill health which may leave them out of pocket for long periods.

In the absence of sick pay, the government could promote income protection (IP) insurance, for example by presenting IP policy options to the self-employed when they complete their self-assessments.

Another means of smoothing income is to clamp down on late payments. Elsewhere, the RSA has called for a Right to a Written Contract for the self-employed, drawing on inspiration from the US.

5. A flat-rate of tax relief would boost the pension pots of millions

Each of our recommendations aims to make it easier for the self-employed to prepare for retirement. However they will continue to face penury in old age unless we grapple with a more fundamental question: where will the money to save come from?

The self-employed take home a third less than their counterparts in salaried work, while half earn less than the equivalent of the National Living Wage. Surprisingly, very few commentators fail to mention poverty wages, perhaps because it makes the debate about saving appear futile.

But it needn’t do. In our report, we finish with a final proposal to reform the tax relief system and thereby free up billions of pounds to support saving among low earners – the self-employed and employees alike.

At present, we have a multi-tiered system that rewards tax relief according to savers’ marginal income tax rate. For every £1 that basic rate taxpayers want to contribute to a pension, they need only add 80p, with tax relief making up the rest. For every £1 higher rate taxpayers want to contribute, they only need to deposit 60p.

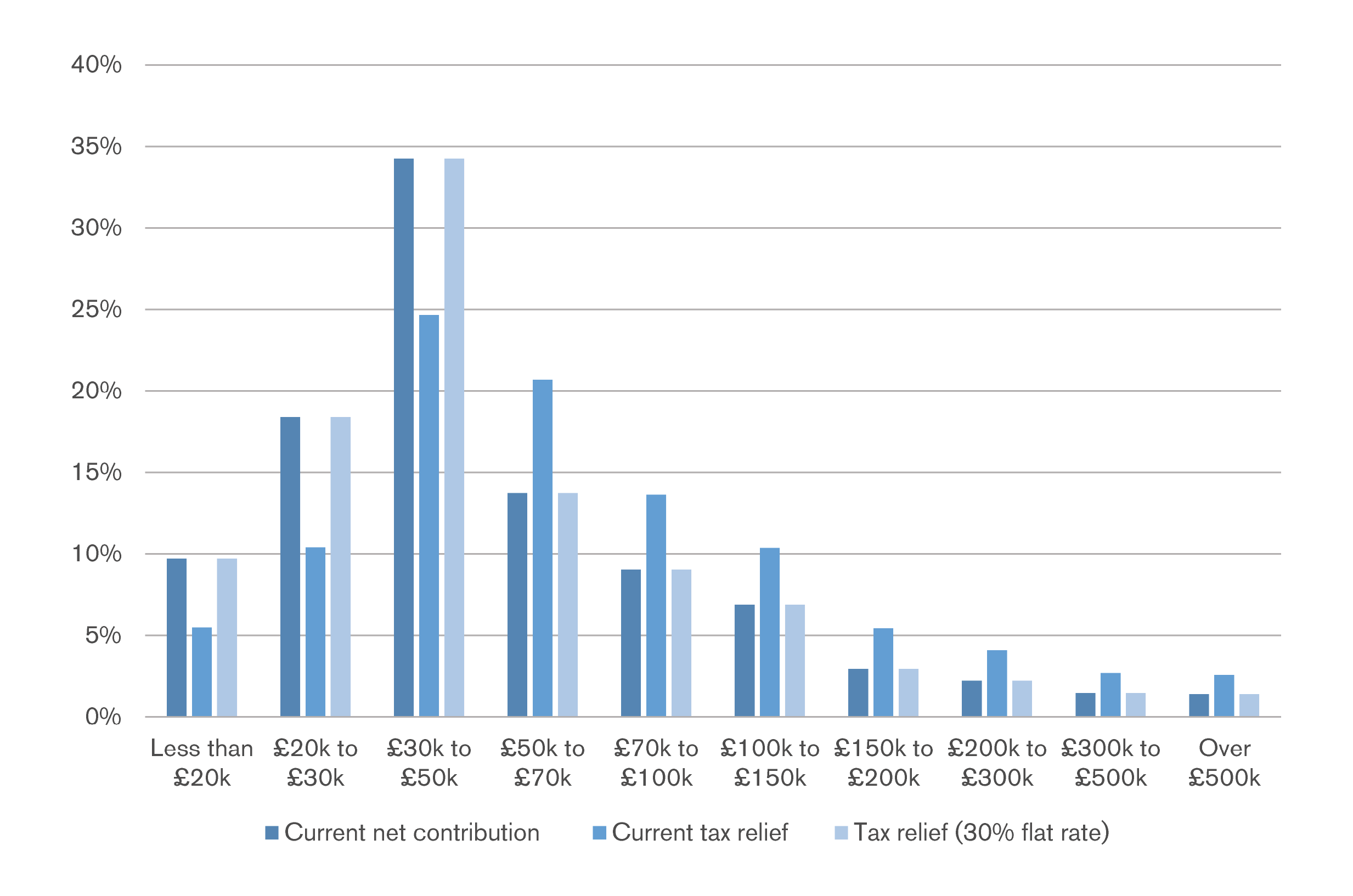

This system is overtly regressive, with 40 percent of the total tax relief expenditure going to the top 10 percent of earners, despite them making just 24 percent of net contributions.

We call for a shift to a flat-rate system with 30 percent tax relief for all earners. Our modelling suggests this would leave 75 percent of savers better off. A self-employed hairdresser taking home £16k, who contributes 5 percent to a pension, would see their tax relief climb from £195 a year to £335.

You can find more detail on our proposal in Fabian Wallace-Stephens blog on tax relief

We hope this report makes a valuable contribution not just to the debate on self-employment but to broader thinking about how our tax, welfare and regulatory systems can respond to a changing labour market. Whether it is tax relief reform or universal basic income, personal learning accounts or sovereign wealth funds, the RSA aims to challenge conventional thinking on policy and practice in service of creating a better world of work.

Download the report: Venturing to Retire: Boosting long term savings and retirement security for the self-employed (PDF, 3.7MB)

Read the report online (on Medium)

Related articles

-

Straws in the wind… which future of work are we heading for?

Rich Mason

As we launch our Four Futures of Work report, Rich Mason considers the seeds for each future scenario we can see in the world today, and the clues for which future economy we may be headed for.

-

A new machine age beckons and we are not remotely ready

Benedict Dellot Fabian Wallace-Stephens

We must push for an acceleration in the adoption of technology, but on terms that work for everyone.

-

Recruiting to Retention: The Emerging Role of Digital Credentials in the World of Work

Jonathan Finkelstein

An exemplar of a Future Work Initiative, Jonathan Finkelstein provides insights on how Credly are addressing the skills gap.

Join the discussion

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.

Speaking as someone who has been self-employed for the past 17 years (all my working life), I did not start contributing to a pension until two years ago, so I went for 15 years without making any provision for retirement. A self-employed income is inevitably precarious leaving little incentive to contribute to a scheme which will not pay out for decades. I contribute a small amount each month, and add a lump sum when I can, but by continuing at the current rate, I would only end up with an annual pension of potentially only around £1,000.

It should be said though that I have already contributed half the qualifying years of National Insurance contributions towards the State Pension, and technically, have another 33 years to contribute, when only another 15 are required. Although clearly NI covers much more than the state pension (and who knows in what format that will exist in 30 years time), a scheme by where we could build up a larger pension pot (either through the state or privately) once we have contributed the full number of qualifying years, would be useful. Plugging gaps in NI records (which is notoriously difficult and complicated) should be something the self-employed are encouraged to do too.

In terms of Income Protection insurance as an alternative to sick pay, this is, again, notoriously difficult to obtain. I suffer from depression and although that’s never affected my work, or required me to take time off work, it’s on my medical record, and insurers won’t touch me because of it. Many self-employed people are in the same position.

Certainly a challenging time to be self-employed in relation to pension provision!