John McDonnell, Shadow Chancellor, recently gave a speech at the TUC’s annual Congress, re-pledging commitments from Labour’s Manifesto to strengthen rights and protections for workers in the gig economy. More rights for workers sounds like a no-brainer and an obvious vote-winner – so why hasn’t the gig economy already been reformed?

John McDonnell has promised to “extend full rights to all workers, including so-called ‘limb (b) workers’, entitling everyone in insecure work to sick pay, maternity rights, and to rights against unfair dismissal.” This is a welcome message, but it’s also one that’s easier said than done. There are three stumbling blocks that he, and any other politician hoping to boost rights in the gig economy, will need to overcome.

1. Confusion about who counts as a ‘gig worker’

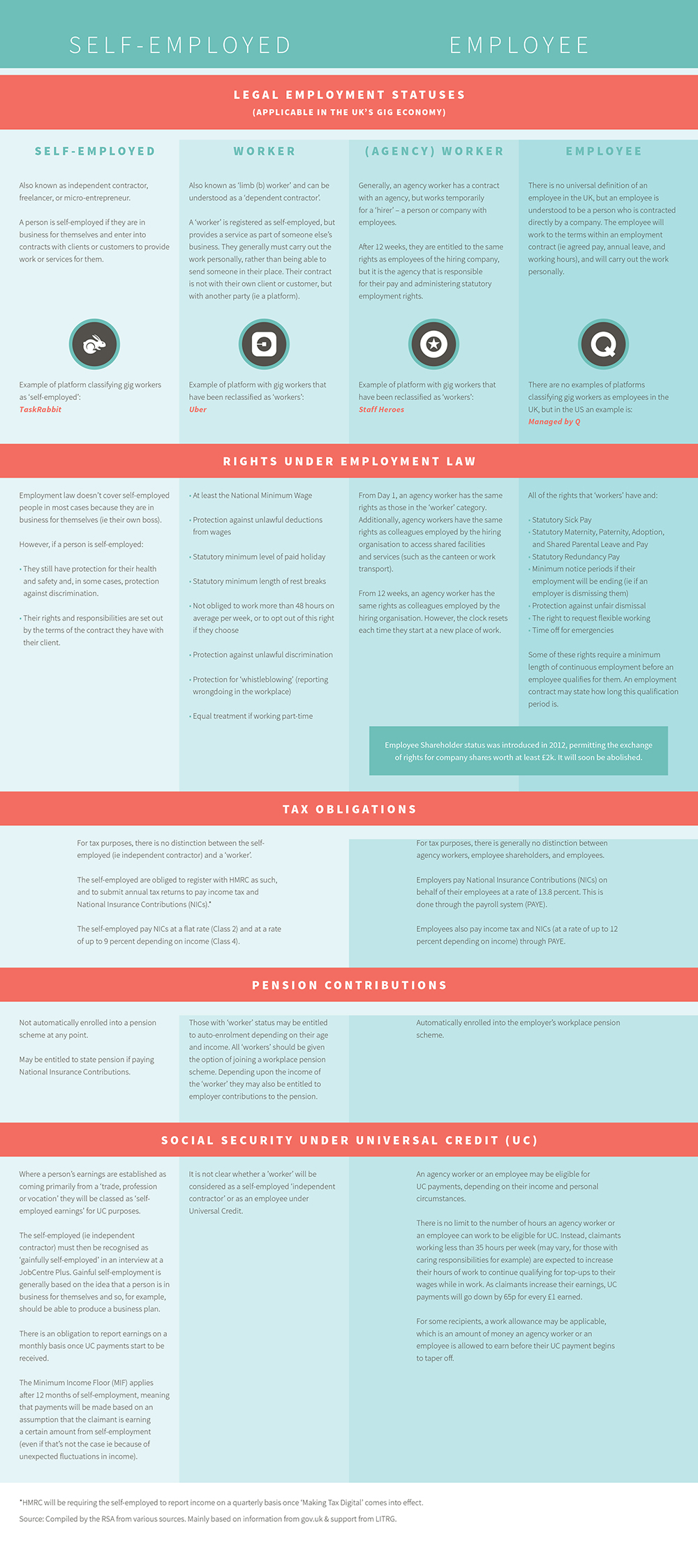

In spite of numerous attempts to define gig workers, politicians and many in the media still conflate gig workers with anyone who takes on a short-term contract or freelance work rather than a permanent job. This means that a gig worker could be an agency worker, on a zero-hours contract, an Uber driver, or the sort of self-employed freelancer who uses a coffee shop as their personal office. Why is this problematic? Because these four different types of worker fall under three distinct categories of worker under employment law, and therefore should not be treated as if they are all the same. Agency workers and zero-hour contract workers are already employees, and thus have more rights than an Uber driver or freelancer, and if Uber drivers are classed as ‘limb (b) workers’ they will have more rights than a freelancer. There are good reasons for this, and often they come down to what sort of relationship you have with an employer or an intermediary, such as a platform like Deliveroo or Helpling.

The RSA defines gig workers as workers who use online platforms to find small jobs, sometimes completed immediately after request (essentially, on-demand). The recognition of the intermediary here is important because the role of the intermediary and how much control a platform like Uber exercises is one of the central reasons why Uber drivers are fighting for more rights as limb (b) workers. By grouping gig workers in with all workers in atypical employment, their particular predicament is glossed over.

However, to complicate things even further, not all gig workers will be classed as limb (b) workers, so is Labour only pledging to extend rights to those who fall into this category or to those who are genuinely self-employed as well?

2. Opposition to raising the national insurance contributions of the self-employed

2. Opposition to raising the national insurance contributions of the self-employed

The reason why gig workers, whether they are limb (b) workers or self-employed, do not already have statutory sick pay or parental rights is because they do not make the same level of national insurance contributions (NICs) that employees do. Both agency workers and zero-hour contract workers are entitled to these rights because, like other employees, they pay income tax and NICs at a rate of up to 12 percent depending on income. In contrast, the self-employed, including limb (b) workers, pay Class 2 NICs at a flat rate and Class 4 NICs at a rate of up to 9 percent depending on income.

In the 2017 budget, the Chancellor tried to raise Class 4 NICs for the self-employed, pledging to subsequently review their entitlement to benefits such as statutory maternity pay. However, he was forced to U-turn after a backlash from self-employed workers who felt that the rise was unfair given the costs of running their own businesses and their lack of a safety net. But if we can’t raise NICs for the self-employed and/or limb (b) workers, how will Labour pay to extend rights to gig workers?

3. Naming who is responsible for covering the costs of these rights

Perhaps Labour or other politicians believe that the costs of extending rights to gig workers should be covered by platforms. But again, they would have to clarify whether the only platforms expected to cover these costs are those with limb (b) workers (which would exclude the majority of gig workers). If so, some of the bigger platforms, including Uber, have already set up schemes akin to that of insurance providers to offer benefits to drivers, such as sickness cover and maternity pay. While some critics have voiced that this is not enough, technically limb (b) workers are not entitled to statutory sick pay or parental leave or pay, so this offer does go beyond current legislation. Does this square with the expectations of politicians, or were they expecting something else?

If it’s the state that aspires to extend these rights, this should be made explicit, and there should be a plan to pay for it. There are several possibilities for covering these costs, including asking workers to make a contribution by raising NICs or possibly introducing a new tax on the companies, and platforms, who use self-employed labour, which could be the equivalent of Employer NICs. There will inevitably be hostility to raising taxes, so politicians must be prepared to engage the public in the trade-offs and make clear what they stand to gain.

Politicians are only deserving of our faith in them to reform the gig economy if they can demonstrate that, at the very least, they are aware of these hurdles and that they have a plan to get past them.

Read our report ‘Good gigs: a fairer future for the UK’s gig economy’

Related articles

-

Budget 2017: Take II on taxing the Self-employed

Brhmie Balaram

The 2017 Budget is another opportunity for the Chancellor to resolve the growing hole in public finances caused by the rise in atypical work.

-

What is the gig economy?

Brhmie Balaram

The growth of Britain’s ‘gig economy’ has been profound. But what exactly do we mean by the gig economy?

-

Taylor Review: pragmatism must prevail

Brhmie Balaram

Brhmie Balaram offers 3 points to keep in mind as we work to ensure a level playing field for both workers and businesses while also serving the public's best interests.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.