Shifting to an age of aspiration requires an environment where risk is seen as an opportunity, the culture is one of optimism, and investment is everywhere, argues Andy Haldane in his Chief Executive’s Lecture. He suggests the RSA’s Design for Life mission can turn the tide of opinion to achieve those objectives.

I am two years in as chief executive of the RSA, a social change organisation of 270 years standing. The world is no better than when I started and in many respects is a bit worse. So that’s a fail. But I want to offer some reflections on success. I want to discuss where we are, why we are here and what might be done to improve things, including through the actions of the RSA. And be warned – I come bearing optimism.

The era of anxiety

We are living in an era of anxiety. Or as Jonathan Haidt, the US social psychologist calls it in his latest book, a ‘generation of anxiety’. It is not difficult to see why. For most people, it has been one thing after another. From the global financial crisis to the climate emergency, from Covid to the cost of living, from the war in Ukraine to the conflicts in Israel/Gaza.

Each of these global shocks has left, and is leaving, deep scars – economic, societal and environmental. This has weakened the systems on which we rely for our security and prosperity: fiscal and monetary, social insurance and healthcare, education and learning, culture and community. We are facing a fragile world with weakened societal immunities.

That is having a scarring effect on us psychologically too. It is adding to anxieties, disconnection and fearfulness for the future. We see that in the rising incidence of loneliness and mental health problems, especially among the young. An uncertain world with weakened support systems and fearful isolated individuals – this is what makes for an era of anxiety.

Fears for the future can be exaggerated at times of stress. History may in time show fatalism has overshot reality. History also tells us, however, that bad news tends to come in batches. Pessimism can be contagious, anxieties viral, fatalism self-fulfilling. And the backdrop – politically, economically, socially, environmentally – gives grounds for pessimism.

Politically, around half the global population goes to the polls this year. A fragile, fractious world adds to chances of polarised or extreme political outcomes. Indeed, that has been the story of this century so far, with extremist and populist parties gaining ground and liberal democracy on the slide for 18 years straight. Larry Diamond, the US political scientist, has called this a ‘democratic recession’.

Geopolitically, the picture is no less fraught. Over 100 wars are currently being waged globally, including conflicts in Ukraine and Israel/Gaza. In large part for reasons of national security, trade tensions continue to escalate, including along the key US/China axis. It is odds against these geopolitical fractures repairing themselves quickly.

Fragilities in our politics are in part the result of the sluggishness in our economies. In the 20th century, global growth averaged over 3% per year. That meant living standards doubled every generation. For the first time in history, generational progress became a social norm. Levels of poverty tumbled from more than three-quarters to less than one-quarter of the world’s population.

During the 21st century, growth has slowed in most countries. Over the past decade, growth per head in the G7 countries has averaged only 1%. Doubling global living standards will, at this rate, take many generations. Rates of global poverty are no longer falling. And some key growth engines of the past – China in the East, Germany in the West – have stalled.

Nowhere is that stasis more pronounced than in people’s pay packets. Once we adjust for inflation, these have flat-lined in the UK for a decade and a half. In the US, they have been treading water for over half a century. The average UK worker is around 40% – almost £14,000 per year – worse off than if pre-crisis trends had continued according to the Resolution Foundation's Stagnation Nation interim report.

This is the first generation for a century likely to be poorer than their parents, with levels of home ownership no better than their great-grandparents. The social norm of generational progress is at risk of being lost.

This has hit hardest the young whose incomes have fallen furthest at the time when they should be rising fastest. This is the first generation for a century likely to be poorer than their parents, with levels of home ownership no better than their great-grandparents. The social norm of generational progress is at risk of being lost.

Most forecasters expect this growth recession to continue given forceful and strengthening structural headwinds. Those headwinds include the weakness in global productivity, with some fearing the lowest-hanging technological fruit have already been picked. They also include our rapidly ageing societies, with 30% of the global population over 65 by the end of this century, shrinking workforces and adding to healthcare costs.

And all of this comes against a background of mounting concern about nature and climate. These risks are no longer hypothetical. Rising flood waters, fires and temperatures are now reshaping the lives of almost everyone. Avoiding environmental tipping points will only come with huge change and at significant cost.

These forces, secular and strong, are the drivers of our fearfulness for the future. In combination, they have ushered in an era of anxiety. Widening social divisions, a fraying social fabric and a scarring of our mental health are among the psychological costs. With justification, US Surgeon-General Vivek Murthy has called this a global psychological epidemic.

The age of aspiration

I hope that is sufficient to have depressed you all. Not for nothing is economics known as the dismal science. But economics is also known as a two-handed science. So, having given you reasons to be fearful for the future on the one hand, let me now give you some reasons to be cautiously cheerful on the other.

That qualified optimism comes from taking a longer-lensed view. History may not be a healer, but it can be a teacher. This more enlightened view of the present, when viewed through the long lens of the past, is one Canadian psychologist Stephen Pinker and Swedish statistician the late Hans Rosling set out comprehensively and compellingly.

We may well be in a democratic recession. But we are also living in the first-ever century in human history where democracy is the dominant political regime globally. It currently covers around 4 billion people. Viewed from space, the world’s political systems would be seen as being just off the peak of a democratic boom, not in recession.

Things could, of course, worsen. Hard times increase voters’ willingness to experiment with political extremes. But contemplating, or experiencing, those extremes can often also encourage reversion to the political mean. We see this clearly in the UK where the main parties will fight this year’s election on a small muddy patch around the centre circle.

Globalisation underwent a golden era in the second half of the 20th century. Having lengthened and deepened, global supply chains have become shorter and more fragile in the 21st century. Security has begun to trump – an apt word – efficiency as a guiding principle for cross-border flows of goods, services and money. Just-in-case has replaced just-in-time.

Yet we remain at or near the highest levels of integration of global trade and finance in a century. Re-shoring and ‘friend-shoring’ have not prevented global trade growing, albeit more slowly, since Covid. Even the worrying pick-up in war and conflict recently comes against a backcloth of a lower incidence of large-scale war than at any point in history.

If we turn to the economy, the picture is not as gloomy as some portray. There is an understandable focus on growth, or lack of it, currently. But it is the level of income, not its growth, that determines our living standards. Almost every part of the world is far richer than at any point in human history. And the slowing of growth has been sharpest in those countries that are already rich.

While plateauing in some countries, global life expectancies and health outcomes have never been higher. Despite the global population never having been older, it has more years left to live than ever in human history. Even the worrying deterioration in mental health, especially among young people, has been greatest in those countries that are richest.

Switching to the environment, on any objective reading we are doing too little, too late to tackle the climate and nature emergencies. Unless we catch up, as Astronomer-Royal Martin Rees pointed out at the RSA's 'If science is to save us' public talk in 2022, there is a non-trivial chance this could be humanity’s final century. This would be the ‘tragedy of the commons’ to end all tragedies.

The qualified good news is that there is now at least widespread international agreement on what is needed to address these crises. This was unthinkable a generation ago. The climate, of opinion at least, has shifted. That may be cold comfort for a hot (and getting hotter) planet, but it is progress. And it is already unleashing a technological wave.

For all its fractures, viewed through a long lens the world is in most respects a far better place to live than ever previously. After a genuinely long period of stasis – measured in centuries – the world broke free from its Hobbesian chains a century or so ago: most people’s lives are no longer nasty, short and brutish. Today is a comma, not a full stop.

But what of the future? Would a historian, having read the story so far, nonetheless be writing a fatalistic next chapter? They would have good source material: high and rising inequalities (between people, and places); AI and technology (devouring our jobs and agency); rapid ageing (shrinking our workforces and increasing care costs); and the climate-cum-nature crises.

There is no disputing the strength, severity and secular nature of these forces. But as well as being the signature challenges of the century, they also represent the signature opportunities. With the right steps taken, they could become potent drivers of a new period of rapid progress, a new Enlightenment, economically, societally and environmentally.

Take inequality. This matters for two quite distinct reasons. The first is social justice or fairness. This aspect tends to dominate public discourse: how is the pie to be sliced more equally? But there is a second reason why inequality matters – inequality signals inefficiency. Tackling it boosts the size of the pie, as well as how it is sliced.

Inequality means that people and places are not fulfilling their potential. It means opportunities are being lost, lives unfulfilled, and resources under-utilised. It is not just morally wrong but economically inefficient for people’s destinies to be dictated by their histories (the problem of social immobility) or their geographies (the problem of levelling-up).

Tackling inequality unlocks that latent energy in people and places. Because these inequalities are high and rising, so too is the latent energy that could be released. Those untapped energy reserves, evidence suggests, could be vast. And because these are untapped human, not natural, resources, this would be a triumph of the commons, not a tragedy.

Much the same can be said of ageing. While often viewed as a burden, this should be seen, quite literally, as the opportunity of our lifetimes provided our longer lives are lived healthily and productively. If so, as Andrew Scott at London Business School set out in his 2023 RSA Public Talk, Building a better society for healthier, longer lives, this could boost growth by more than 1% each year and levels of wellbeing by much more.

The same logic applies to the climate challenge. Nick Stern at the LSE (author of the hugely influential 2006 study, The Economics of Climate Change: The Stern Review) believes this is just the jolt we need to drive us out of stagnation, by investing and innovating in green technologies. With large-scale investment, he suggests that global growth could be boosted by 2% per year while averting planetary threats.

Finally, on AI, there has been much doom-mongering about its threat to our jobs and agency. As at the time of previous industrial revolutions, that threat is real. Yet the evidence so far points in a different direction. As during the first three industrial revolutions, most AI so far appears to have been a job creator and enhancer, not a killer and inhibitor.

Even if more AI means we work fewer hours, this does not necessarily mean less pay. It is productivity, not hours, that drives pay, and AI is the ultimate productivity enhancer. Indeed, shorter working hours would speed us on our passage to what, almost 100 years ago, John Maynard Keynes called the economic possibilities for our grandchildren – a 15-hour working week.

Whether the mega-trends of the 21 century – inequality, ageing, climate and AI – prove to be for societal good or ill depends ultimately, then, on us. These momentous shifts fatten up both the upper and the lower tails of opportunities and outcomes for society. They add to both threat and opportunity, for individuals and societies.

In previous such episodes of wrenching change, including at the time of the industrial revolutions of the 18th, 19th and 20th centuries, society adapted in ways that harnessed the upper-tail opportunities and largely avoided the lower-tail threat. We know this because that is the reason our world was able to break away decisively from its Hobbesian chains.

This time is different, but the opportunity is no less. With skill, it could usher in a new age of aspiration. But doing so will require a new set of social systems. So let me now turn to what might be needed to achieve this system shift, from fatalism to dynamism, from anxiety to aspiration, from lower-tail languishing to upper-tail optimism.

Stronger floors, longer ladders

Left unattended, anxiety is self-fulfilling. Fearfulness about the future heightens our aversion to risk and reduces our horizons for planning. By fueling fear and myopia, anxiety causes us to invest too little in the future. That lack of investment is the exact opposite of what we need to strengthen our economies and societies and create a better future.

Investment relies on optimism about the future and innovation to reshape it. As history demonstrates, if we are to harvest the opportunities (and avoid the threats) of technology, ageing, inequality and net zero, a culture of creativity and calculated risk-taking is needed. We require what economist Joseph Schumpeter called ‘creative destruction’.

Yet economies and societies currently show too few signs of creative destruction and dynamism. Across markets, sectors and actors – workers, businesses, governments – decisions are weighed down by risk aversion, a fearfulness of investing for the future. If continued, this lack of dynamism risks being self-fulfilling, missing the opportunities of our lifetimes.

Let’s start with workers in the labour market. The good news is that unemployment, the scourge of labour markets in the 1980s and 1990s, appears largely to have been purged from our economies. Unemployment rates across most advanced economies are around 3-5%, close to their natural rate below which inflation starts to rise.

The less good news is that two different labour market scourges have emerged in its place. In the UK, around one in five adults of working age are not in work or training and are not seeking either. That is around 9 million people. They are, in the jargon, economically inactive. We see similarly large fractions of the workforce inactive in other economies.

A market with more than 20% of its resources unused, and more people exiting than entering, is not a dynamic one. It worsens inequalities of opportunity and outcome. And while most acute among those over 50, inactivity is rising fastest among those under-25 – one in eight are inactive. This risks constraining lifelong opportunities for millions of workers.

The lack of dynamism is not confined to those out of work and training. Despite employment rates being high, wage rises for those in work have stalled. A lack of dynamism in the UK jobs market is one of the key reasons for this stasis in pay because one of the fastest and most effective routes to a pay rise is by moving job.

Going back many decades, rates of job movement are far lower in the UK than in the US, by a factor of around two. But these rates of job transition have fallen further in the UK over the past 15 years since the global financial crisis, by around 50%. This is likely to have reflected heightened anxieties among workers, putting job security over job moves.

This is mirrored in the behaviour of business. One metric of business dynamism – the reallocation rate – sums job creation and destruction rates. Rates of job destruction and creation by companies have both fallen materially over the past decade. The reallocation rate has fallen from around 30% to around 20% over the course of this century. Schumpeter lies slumped.

We see this too in churn rates among companies. At least until recently, the UK had a long period after the global financial crisis of very low company bankruptcy rates, with levels roughly a third lower than their average over the past century. Poorly performing companies, which historically may have died, have instead remained alive if not kicking.

This lack of business turnover has stunted the natural reallocation of resources – people and capital – towards more productive UK firms. We see evidence of that in UK productivity trends. Productivity in the UK has stalled over the past 15 years and the gap with our international competitors, such as the US and Germany, has risen to between 15-30%.

Low rates of churn have hindered the dynamism of a large and growing share of UK PLC, with costs in static productivity and pay. There has, simply put, been too little creative destruction.

These stalling trends and widening gaps can be fully explained by a long and lengthening tail of UK companies with low and stalling productivity. Low rates of churn have hindered the dynamism of a large and growing share of UK PLC, with costs in static productivity and pay. There has, simply put, been too little creative destruction.

Interestingly, the UK’s best-performing businesses are more productive than international counterparts. This fits with the narrative of the UK having a fertile research and innovation sector with more unicorns – companies worth more than $1bn – than Germany and France combined. The UK does the ‘creative’ well, even as it does the ‘destructive’ poorly.

But despite the rich pipeline of research start-ups, many promising UK companies are lost in the journey from start-up to scale-up – the ‘valley of despair’ for British businesses. They find themselves either unable to find scale-up funding or can only do so by selling to overseas investors. The foreign sale and listing of ARM Holdings, one of the technological jewels in the UK’s crown, is a case in point.

This has left the UK without the equivalent of the German ‘Mittelstand’ – dynamic, medium-sized businesses driving productivity and growth. The valley of despair has left UK business with a missing Mittel. And the absence of that energetic middle tier has in turn contributed to ossification at the upper end of the UK corporate sector.

The average age of the ten largest US companies is 50 years. Two were formed this century. Big US business is a combination of sprightly middle-aged and energetic adolescent. By contrast, the average age of the top 10 UK companies is 156 years. They are, by comparison, bed-bound geriatrics. The average age of big UK and US businesses differs by over a century.

This is a telling diagnosis on the lack of dynamism in the UK corporate sector. It is reflected in their valuations too. The market value of Apple alone is twice that of the entire FTSE-100. Five US companies – Microsoft, Apple, NVIDIA, Alphabet and Amazon – are valued more highly than the entire top-tier of UK businesses.

This lack of dynamism, top to tail, operates across all sectors. It both results in, and is caused by, a failure to invest. UK companies rank well down the international league tables for investment, both in physical and intangible capital (such as R&D) and in people. And a failure to invest for the future is a surefire sign of pessimism, risk aversion and short horizons.

This risk-averse behaviour is not confined to non-financial companies. The risk capital allocated by banks and non-banks to support risky ventures has been in secular retreat for several decades. This has siphoned off the financial fuel needed to power companies from start-up to scale-up and help them escape the valley of despair.

Banks’ risk appetite was deeply scarred by the global financial crisis and made worse by the tighter financial regulation following it. But their appetite for business risk has been falling for far longer. As a fraction of their balance sheets, bank lending to UK businesses currently sits at less than 10%, down from levels of around a quarter in the 1980s.

For non-bank financial firms, such as pension funds, the picture is much the same. For them, risk-taking has been restrained by the risk aversion of their trustees, compounded by accounting and financial regulation. The fraction of their assets they invest in UK businesses currently stands at 1.5%, down from a third in 1992.

This culture of private sector risk-aversion is mirrored in the public sector. Many governments have over recent years supported sectors facing adversity – the banks during the global financial crisis, companies and households during the Covid and cost-of-living crises. This has ratcheted up government debt in the G7 to its highest levels in half a century.

With debts and deficits high, many governments are now fearful about using their balance sheets to invest, especially when undertaking large, long-term, transformational projects. UK public investment has been weak by historical and international standards for several decades and is projected to remain well below the levels of other OECD countries.

These risk-averse responses, public and private, are individually understandable given the risky environment. But they are also collectively self-defeating. As Keynes articulated in the 1930s, the paradox of thrift is that it can turn an individual virtue into a collective vice, making a bad situation worse. This world today finds itself in a similar position.

In an era of anxiety, the paradox of people seeking safety and security is that this stymies the very risk-taking and investment needed to solve security and prosperity problems. Unattended, risk aversion amplifies the risks and insecurities facing people. The instinctive response, a flight from risk, is precisely the wrong one.

So while the world is anxious about change, the paradox is that, without change, these anxieties will grow. At present, there is not too much change in the world, but too little. Most markets are experiencing too little destruction, not too much. At a time of unrivaled upside opportunity, people are seeing only downside threat.

In an era of anxiety, the paradox of people seeking safety and security is that this stymies the very risk-taking and investment needed to solve security and prosperity problems.

These features are not unique to economies. The richest ecosystems, such as tropical rainforests, have dynamism as well as a fragility. By contrast, ultra-stable ecosystems, such as deserts and savannahs, have no such richness or dynamism. Currently, we are facing the economic equivalent of desertification – too much stability, too little dynamism.

What is needed to shift us from desert to rainforest? To do so, our social systems need to be reconfigured in two ways. First, they need stronger and more secure 'floors’, to protect individuals, communities and societies from the risks they face. This catches people when they fall and stops them fearing the worst. This is a necessary antidote to the era of anxiety.

But it is not a sufficient one. We also need taller and more robust ‘ladders’ to enable the same people to climb and fulfil their potential. We need optimism about the future, and realistic pathways to success, to encourage people to invest in their future. We need sturdy and lengthy ladders to stir animal spirits and see uncertainty as friend not foe, opportunity not threat.

It is only by investing in both stronger floors and longer ladders that we can shift our collective risk-taking sights away from the lower tail of anxiety (on which it is currently fixed) and towards the upper tail of optimism (where opportunity knocks). This is how we can re-balance the Schumpeterian scales of creative destruction in our favour.

Reducing anxiety at source is at the heart of the ‘Securonomics’ agenda developed by Shadow Chancellor Rachel Reeves and delivered in a speech in Washington DC in May 2023. This strategy makes perfect sense. In an insecure world, reducing fearfulness diminishes anxieties and adds resilience to economies and psychologies. This is the case for stronger floors, and it is a necessary ingredient of success.

But it is equally clearly not a sufficient one. Realising the potential of people and places requires longer, stronger ladders, especially for those on the lowest rungs. That ladder creates and enables a shift in risk-taking culture, inspires investment in the future and leads to aspiration trumping anxiety in a self-fulfilling loop.

The paradox of security is that it is only by taking risk today that you can reduce it tomorrow. To achieve this, strong floors and security are good but not good enough. On these strengthened floors need to be placed longer, stronger ladders. Even discussion of them is sadly absent from much public policy discourse at present. This needs to change.

Viewed through the prism of floors and ladders, we can see how different countries have positioned themselves and the success and failures this has delivered. A pure free market model caps neither downside nor upside – a long ladder with no floor. This increases the dynamic incentives to climb, but at the expense of vertiginous falls for those who fail.

The US perhaps comes closest to this model of long, precarious ladders. State insurance for unemployment or healthcare problems is weak. But investment and innovation, job and business churn are high. The result is high growth, but with high inequality and precarity. The twin opportunities of ‘creation’ and ‘destruction’ are treated just the same.

At the other end of the spectrum would be countries with heavy state intervention, capping both floor and ceiling, such as models of communism and state socialism. The result is lower dynamism and growth but greater levels of security and lower degrees of inequality. The twin imposters of ‘creation’ and ‘destruction’ are treated just the same.

The UK model holds a mid-Atlantic position, being neither as dynamic as the US nor as precarious for its workers and businesses. Perhaps the most interesting cases, though, are those countries that combine dynamic, fast-growing economies with strong social safety nets. The Scandinavian countries, Singapore and Korea would fall into this camp.

This begs the question of whether the UK could strike a different balance between its floors and ladders, the creative and destructive, insurance and investment. Could our social systems be reconfigured in ways that add dynamism without precarity? The answer to that question is I believe yes.

A new Enlightenment

Let me discuss four areas where action could and is being taken at the RSA as part of our Design for Life mission. These are measures intended to both strengthen floors and lengthen ladders. While not comprehensive, they are the sort of systems-shifting initiatives needed to switch us from anxiety to aspiration. Each requires a root-and-branch systems rethink.

Design for Life

Read about our mission to enable people, places and the planet to flourish in harmony.

These actions build on the opportunities (and challenges) presented by the 21st century. They are about stimulating risk-taking and encouraging investment; nurturing social connectivity and social mobility; rethinking and reconfiguring learning; and regenerating places to unlock their potential. All require boldness in design and delivery.

Rethinking risk, rules and regulation

Almost a century ago, facing deep anxieties during the Great Depression, Keynes proposed a radical shift in policy to break free from the paradox of thrift. This involved the state acting entrepreneurially, shouldering more risk through improved insurance (stronger floors) and greater investment through public works (longer ladders).

This policy package was mirrored in President Roosevelt’s New Deal in the US, a programme of economic revivification through public works. Both were, in time, a success. By strengthening floors and lengthening ladders, anxiety was replaced with aspiration, thrift with investment, and depression with dynamism. All boats were lifted especially the smallest ones.

Although today’s conditions are different, this logic remains as strong as ever. Government is the agent in society with the longest time horizon. It is best placed to make large, long-term transformational investment. It is best placed to take calculated risks which yield large societal benefits into the future. Government is society’s anchor venture capitalist. Or should be.

This anchoring role is especially important when risk-taking and investment are too low. In those circumstances, government has prime responsibility for bearing the first loss, undertaking the first investment. The best way of government demonstrating optimism about the future is by investing in it, putting their money where their mouth is.

Yet the opposite is happening. UK investment, public and private at around 17% of GDP, is five percentage points below the G7 average and over 10 percentage points behind high-growth economies. Worse still, the government’s forward projections for investment put it on a downward path, not an upward one.

This begs the question why. That question has a surprisingly simple answer – the UK’s fiscal rules. In principle, fiscal rules have the sensible aim of curbing excessive spending by governments. They limit fiscal risk and the tax burden on future generations. Whether fiscal rules achieve these objectives in practice hinges crucially, however, on their design.

In the UK and a number of other countries, the current design of fiscal rules risks being self-defeating on its own terms. In particular, rules on the levels of debt can risk both short-termism in fiscal decision-making and put a brake on investment spending. As economies grow out of debt problems, and today’s investment is tomorrow’s growth, this makes debt-based fiscal rules a potential problem.

In the UK and a number of other countries, the current design of fiscal rules risks being self-defeating. In particular, rules on the levels of debt can risk both short-termism in fiscal decision-making and put a brake on investment spending.

One of the UK’s fiscal rules, which would also be adopted if a Labour government came to power, is to require debt to be on a falling path at the end of five years. This rule is the binding constraint on fiscal choices at present. It explains why projections are falling for UK investment and is contributing to a weak medium-term growth and fiscal outlook.

Breaking free of these fiscal constraints would allow greater long-termism and dynamism in fiscal decision-making. The first could better be achieved by having something akin to the Well-Being of Future Generations Act, introduced in Wales in 2015. This puts the fiscal focus on long-term outcomes – Keynes’ economic possibilities for our grandchildren.

That second element, greater economic dynamism, could be achieved by switching from fiscal rules focused on gross debt to ones based on net worth – assets less liabilities. That would provide room for government to borrow to invest in transformative, large-scale, long-term projects that grow assets and net worth, despite boosting borrowing, and boost medium-term growth.

These are precisely the projects existing fiscal rules are most likely to disallow. The thin-slicing and eventual scrapping of HS2 was one casualty of these rules under the current government. The thin-slicing and near-scrapping of the Labour Party’s green prosperity plan is another. In sticking to the fiscal rules, some of the opportunities of our lifetime were lost and medium-term risks to growth and the fiscal outlook increased.

There is an understandable desire to repeat the eruptions caused by the UK mini-budget of 2022. But this risk needs not to be overstated. International bond markets seem to understand that debts and deficits are not all created equally. Government borrowing is not a cause for concern provided it is directed towards boosting growth and increasing net worth over the medium term.

Countries with high net worth appear to benefit from lower borrowing costs. High gross debt has, by contrast, a mixed relationship with borrowing costs. Singapore has very high debt levels by international standards, at 170% of GDP. But, because it used borrowing to finance investment and fuel growth, it has high net worth and enjoys lower borrowing costs than the UK and US.

What is true of fiscal rules is true of rules intended to reshape risk-taking in the private sector too. While also designed to curb risk-taking and protect citizens, these can sometimes inadvertently have the opposite effect. A culture of compliance and consumer-protection can in fact result in poorer outcomes and greater risks for society at large.

That compliance culture was evident last year in the row over ‘de-banking’ Nigel Farage. Since then that row has spread, with around 140,000 companies having had their bank accounts closed last year alone. This was with the aim, purportedly, of reducing risk to banks. Somewhat to my surprise, last year I discovered I was a ‘Nigel’ too.

I tried opening a bank account and was told I had been rejected. When I enquired why, I was told it was because I was ‘politically connected’ due to my working for the Bank of England. This was odd. First, I did not work for the Bank of England. Second, the Bank is by statute independent of politics. And third, the Bank was also their regulator!

This mistake was soon corrected, apologetically. As in Little Britain, it was apparently the computer that had said no. But whether this compliance culture is computer- or human-generated, the consequences are the same: cultures and practices in banking which make doing business and taking reasonable risks harder work and more costly, denting dynamism.

Compliance culture is not confined to consumer protection. In a previous life I helped develop the post-crisis Basel III regulatory standards for banks. This many-headed beast had the best of intentions. But the result is a framework which man-marks every moving part of banks’ balance sheets. It has dulled banks’, and investors’, appetite for risk: most European and UK banks are valued below their book value.

This dulling of risk appetite is not confined to banks. A combination of accounting and regulatory rules – another monster, Solvency II – resulted in UK pension funds de-risking their balance sheets over many decades. Holdings of UK companies were displaced by government bonds, shrinking the supply and increasing the cost of capital for UK companies. This helps explain the ossification of the UK market for quoted companies.

Recently the tide has started to turn. The Chancellor’s Edinburgh Reforms signalled a shift in risk appetite by pension fund regulators. And the Mansion House Reforms last year suggested a shift in risk appetite among asset managers. Time will tell whether pension funds and their regulators put their monies where their mouths are and return to providing risk capital to UK businesses.

Rules and codes around corporate governance have followed a similar path, rising rapidly this century. They too have the best of intentions but have added to the bureaucratic burden on companies and had a chilling effect on boardrooms. These governance codes have given boards another reason to look before they leap, to delay investment decisions.

In their efforts to lower micro risks, many of our fiscal and regulatory rules may have amplified macro risks. By being penny-wise, they have ended up being pound-foolish for dynamism and medium-term growth. In this environment, rethinking and redesigning these rules could encourage risk-taking, strengthen ladders of investment and reignite growth.

Rethinking social connectivity

When thinking about the raw ingredients of societal success, we often give prominence to a set of ‘capitals’: physical (land and machines), human (skills and experience), intangible (IP and software) and natural (climate and the environment). Individually, and especially collectively, these are key ingredients in the recipe for societal success.

But there is one crucial ‘capital’ that is a missing ingredient from this recipe: social capital – the strength of our network of relationships and values. This is the poor relation of the capitals, often under-valued and under-appreciated. It is seen as difficult to define and measure. And what is not measured or understood tends not to be managed or valued.

Recent research on social capital has shown this is a huge oversight. Indeed, it has demonstrated that improving social connectivity and social cohesion may be one of the single most effective ways of simultaneously strengthening the floor and elevating the ladder of opportunity for the poorest and most vulnerable in society.

Social capital can be a slippery concept. To try and pin it down, academics often divide it into two distinct but related concepts: bridging capital (social connectivity) and bonding capital (social cohesion). Both are important in enabling people and places to flourish, but for slightly different reasons.

Social cohesion refers to the common values and characteristics that bind us. Empirically, it has been found to be crucial for nurturing a sense of trust and wellbeing and for curbing anxiety and loneliness. It provides a strong collective, communal floor for people and places, on which in particular those that are most vulnerable rely.

Social connectivity refers to the strength of our network of relationships. Empirically, it has been found to have a large and lasting influence on lifespans and life chances. Longitudinal studies over generations in the US have shown that the quality of our social connections is key in shaping lifetime incomes and life expectancies.

Recent evidence, also from the US and looking across a very large cross-section of individuals in different districts, finds an equally strong and striking link between social connectivity and social mobility. Indeed, it appears there is no more important determinant of social progress than the strength and depth of your social network.

Reading this research was, for me, a hallelujah moment. Patterns of social mobility across the US and the UK have been strikingly static for much of the post-war period. What is sometimes called the ‘class ceiling’ has been difficult to break. The ladder of opportunity simply hasn’t existed for many people.

The recognition that growing social capital and nurturing social connectivity could play a crucial role in rebuilding the ladder of opportunity for disadvantaged people opens up vast new policy opportunities, in what has been a neglected and under-explored contour of public policy to date. You might call this ‘social capitalism’.

One aspect of social capitalism is investment in social infrastructure. This is infrastructure explicitly designed to develop social connections and cohesion: museums and libraries, sports and leisure facilities, youth and community centres, parks and playgrounds, faith-based organisations.

Yet social infrastructure, like social capital, is the poor relation of the infrastructure world, with spending on it a tiny fraction of what is spent on physical and digital infrastructure. This is a market failure – a failure to recognise the high lifelong social returns, individual and communal, from social investment.

The responsibility for investing in social infrastructures is a shared one. Government plainly has a key role. But private capital, and social investment in particular, also has a clear role. This market remains primed for lift-off. I hope the likes of Better Society Capital (previously Big Society Capital), now in its second decade, can help provide the rocket fuel.

The RSA is stepping up its role in nurturing social capital and connectivity. For us, this is back to the future. As a product of the coffee house culture of 18th century Enlightenment England, social connectivity has always been at the heart of the RSA. Through our Design for Life mission, we are now making it a golden thread in all of our interventions.

As one example, as part of our Social connections intervention, we are working with Meta and the Behavioural Insights Team to understand the links from social connectivity and mobility in the UK. This will help us not only to better understand patterns of social connectivity across the UK, in a granular fashion, but to craft interventions to nurture them.

This could be done by considering interventions at different points in people’s lifecycles – in school classrooms, on sports fields, in workplaces, in community centres, on social media. These would be attempts to rewire social networks, a sort of ‘libertarian paternalism’. In such a fledgling area, a degree of experimentation and learning-by-doing will be necessary.

Social connections

Working with Meta's 'Data for Good programme' we will leverage insights from Facebook data to better understand how all forms of social connections between people affect the opportunities they have in their lives. We call this ‘social capital’.

The prize is tantalisingly large. Social network rewiring can be done at a relatively low cost by comparison with other social mobility initiatives. And research suggests the benefits for individuals could be big. Evidence suggests a rewiring that connects well-connected (rich) with poorly connected (poor) young people boosts the latter’s lifetime income by 20%.

This would be a brave new world for policy, focused on a different source of capital, a different set of success metrics, a different set of investment propositions, a different approach to intervening. With social capital and connectivity denuded, now feels as good a time as any, and the RSA as well-positioned as anyone, to push that policy frontier.

Rethinking skills and learning

If improved social connections are one ladder of opportunity, so too are our education and learning systems. Who you know really matters (who knew?). But what you know matters too. A firm foundation of skills provides the floor for most people’s work and lives. And a lifelong ladder, enabling new skills and learning, gives purpose and aspiration to people’s lives.

Yet this ladder of learning is, for many, broken – lower rungs removed, upper rungs unreachable. For them, the foundational floor of skills is insecure and the ladder unavailable to climb. These educational false starts begin in the early years and widen over the life course, meaning those most in need of lifelong learning are least likely to undertake it.

We see that in the high and rising numbers of young people absent or excluded from schools; in the third of young people leaving education loathing learning; in the splintered learning pathways for people not taking degrees; in the third of 18-year-olds not in education or training; and in the widening skills deficits of around 10 million people in the workforce, constraining growth across every sector and in every corner of the UK.

Yet despite this, education and skills are not an especially rich dimension of public policy debate and discourse currently, even in the run-up to an election. I find that as troubling as it is perplexing. Perhaps it is in the too-difficult box for risk-averse politicians and policymakers. Either way, I think this is a miss and I am committed to the RSA helping fill this policy vacuum.

Doing so will require a root-and-branch rethink of the learning ladder from early years to entrepreneurs. This rethink needs to focus on those furthest from its lowest rungs, including the 9 million in neither training nor work. Once on the ladder, our learning system then needs to encourage people to climb it on a lifelong basis, reskilling to boost their pay.

Achieving these objectives calls for a fundamental rethink of what we learn – the nature of the curriculum. But, as importantly, it will require a rethink of how we learn – embracing different learning styles. It will also require us to rethink when we learn – with learning focused not just on the young but on developing skills on a lifelong basis.

If that sounds like a big shift in our learning model, it is no larger than the one achieved during the 19th and 20th centuries in which the RSA played a leading role. And some elements of this new learning model are clear. Learning needs to be more practical (than academic), experiential (than examined), digital (than physical), personalised (than homogenised), lifelong (than youth-centred) and granular (than lumpy).

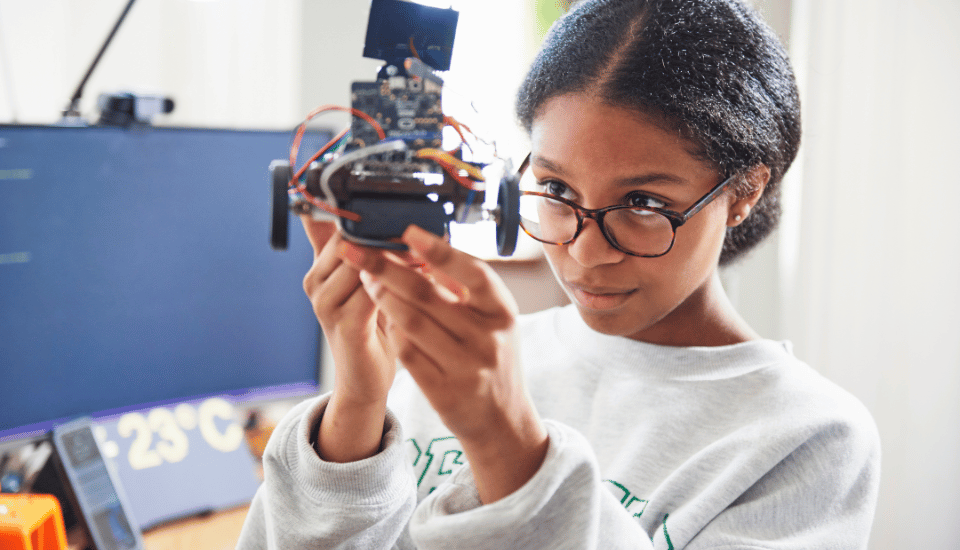

Two of the Design for Life interventions, our Playful Green Planet and Design for Life Awards programmes, are sculpted in that mould. They offer a different approach to learning, rooted in real-world problem-solving. They put creativity centre-stage, from cradle to career. Both build on the RSA’s legacy, including the world’s longest-running Student Design Awards which turn 100 this year.

Playful green planet

Co-creating nature-based urban learning spaces and activities for 3-5-year-olds to foster nature and community connectedness and care through creativity.

Design for Life Awards

Offering collaborative and inclusive learning experiences for children, learners and entrepreneurs helping them grow the capabilities and ideas needed for a regenerative world.

For example, Playful Green Planet is an early-years intervention working in partnership with the Eden Project in Cornwall. It will allow young children to develop ‘mini-Edens’ in their schools and communities, to nurture their love and understanding of nature in a practical, team-based setting. It will focus on children from the most deprived areas of the UK with least access to nature.

Our new Design for Life Awards intervention, to be launched later this year, will focus on learning among pupils through to adults. It will offer team-based and practical learning pathways, partnering learners with business to root learning in real-world issues. It too will focus on those most likely to be absent or excluded from formal education or training.

These interventions are about strengthening the lowest rungs of the learning ladder for those furthest from them, developing a love of learning that has the chance of becoming lifelong. They are about a different style of learning, personalised to learners who have agency over what and how they learn. They are about showing there is another educational way, starting local, aiming global.

These initiatives will not address the large fraction of the workforce already lost to both work and learning. Getting them back onto the work and learning ladder requires multi-faceted support given their multi-faceted needs – health, skills, flexibility, and caring. Yet existing pathways into work and training for these people are often unfathomably complex.

The RSA’s Cities of Learning intervention was put in place for just this reason. By connecting disconnected parts of the learning and skills system, it established clear skills pathways for lost learners across eight UK cities. These pathways were focused on the skills most needed by local firms, speeding learners’ passage back to work as well as learning.

The Cities of Learning programme also established new rungs on the learning ladder, with micro-credentialling of practical skills recognised through digital badging. This made it easier for learners to get started and gain confidence on the learning ladder, with rungs at both lower levels and with the distance between them smaller, encouraging people to climb.

We are now aiming to build on the success of the Cities of Learning trial, with an even greater focus on those people furthest from learning and work. We are expanding the footprint of the trial from cities to Regions of Learning. And later this month, partnering with Ufi, we are establishing a Digital Badging Commission to explore its role in this new model of learning.

Cities of Learning

Connecting and catalysing place-based lifelong learning to unlock opportunities for a regenerative economy.

Digital badging

Championing digital badging as a recognised learning hallmark for informal learners of all walks of life, especially for the skills needed for a regenerative economy.

Our skill-based initiatives are about constructing a new ladder of learning for those for whom it is currently out of reach. They are about creating pathways for navigating the treacherous labyrinth of the skills system. They are about tackling socio-economic and spatial inequalities at source. And they aim to add aspiration to everyone’s lives.

They will, I fear, be insufficient by themselves though to tackle all of the UK’s inequalities. That I think will require stronger national floors on which to place these longer local ladders. This educational floor is often absent. For people without a degree, there is a better than evens chance they are receiving neither education nor training at age 18.

One of the problems here is that, unlike for higher education, funding for further education and apprenticeships is capped, either by the government or by the apprentice levy. This has contributed to Further Education funding falling 50% since 2010 and the number of young people in apprenticeships falling by over a third since 2016.

The Apprenticeship, Skills, Learning and Children Act 2009 established an apprenticeship guarantee for all 16-18-year-olds that was intended to guard against these problems. But this act was repealed in 2010. Replacing that guarantee could provide a vital floor for young people at the very start of their careers. It would help tackle the chronic inequality of skills opportunities and the UK’s low skills problem at source.

Indeed, I think there would be value in considering a more ambitious system of skills guarantees on a lifelong basis. For example, in Denmark the ‘flexicurity’ system combines a high degree of flexibility in hiring and firing among firms with much higher levels of income and training support for displaced workers, facilitating their reflow back into work.

As a point of comparison, average levels of income support for those out of work are typically at least twice UK levels and levels of training four times greater. This has resulted in a Danish labour market that combines low unemployment and high degrees of dynamism with significant income and reskilling security for workers. It contains both longer ladders and stronger floors, with the latter supporting the former. The UK could learn from it.

The RSA was in the vanguard of developing today’s educational model in the 19th century. Alas, that model has barely budged over the period since. It plainly is no longer fit for purpose. Through its Playful Green Planet, Design for Life Awards and Regions of Learning interventions, the RSA is now putting itself in the vanguard of helping develop a new, fit-for-21st-century purpose, learning ladder.

Rethinking placemaking

Do you know how I cheer myself up these days? I get as far away from Westminster and Whitehall as possible, to the UK’s regions and nations. That is where I find the energy greatest. If that latent energy could be released, it would super-charge national UK prosperity. The best national prosperity plan is, for me, built from the bottom up.

The upside of the UK’s large and widening spatial inequalities is that there is huge latent potential if poorer places could be levelled up. This is economic inefficiency of inequality. As set out in our UK Urban Futures Commission report last year, if released across the UK’s major cities this could add £100bn each year to national income.

What is necessary to unleash this potential? What are the stronger floors, and longer ladders, local leaders need? I believe there are broadly three, each of which was discussed in the UK Urban Futures Commission report. They involve the endowment of greater powers, monies and assets to local leaders, underpinned by an over-arching Local Prosperity Plan.

On local powers, there has been significant progress in devolving these over the past decade. Devolved regions now comprise almost two-thirds of the English population and 90% of the North. With the new trailblazer deals, these powers are now deepening as well as widening. These moves would be accelerated under a Labour government, who have committed to a Taking Back Control Act.

UK Urban Futures Commission

Unlocking the potential of UK cities, to drive economic, social and environmental improvements for people and for the country.

Yet even once in place, the UK would remain one of the most centralised nations in the world for spending and, in particular, taxation. We will need even greater boldness in decentralisation to unlock the full potential in places. For me, this calls for flipping the power presumption, with local leaders rather than central government defining what powers they need to make good on their strategy.

This would make local leaders genuine masters of their own destiny. It would create a healthy degree of experimentation and competition among leaders in their approaches, from which national lessons could be learned. And it would, with taxation powers devolved, help cement greater local accountability into the devolution process which is necessary.

All of this will require bravery from politicians – not so much taking back control as willingness to let go. It will require a tolerance for local mistakes, with the response to them to learn lessons and improve rather than retake back control. It will require a strengthening of OfLog’s (the Office of Local Government – possibly the world’s worst acronym) remit.

Powers are nothing without money. As the financial perils of many local councils across England demonstrate, this is in short supply. This is hardly surprising given the 30% real-terms cut in local authority funding since 2010. This has led to many local areas slicing non-statutory services (such as housing and transport) and investments to keep the street lights on.

This is not a recipe for long-term success. The funding formulae for local government bear little relation to the social and economic needs of places, such as measures of deprivation. These funding rules need a root-and-branch reform, taking account of the huge disparities not just in the flow of finance but in the stocks of capital in different places. Newcastle’s capital stock per head is a tenth Westminster’s and a third Manchester’s.

Ultimately, though, the lion’s share of the financing for regeneration will need to come from private rather than public sources. The good news is the world is awash with cash. The bad is that too little of this currently finds its way outside of the UK’s “Golden Triangle” – the London/Oxford/Cambridge axis – to its regions and nations.

We see that in flows of risk capital to the UK’s most innovative businesses, with more than three-quarters of the UK’s venture capital flowing to the South-East. And we see if too in the higher risk premia – and accompanying higher cost of borrowing – on otherwise-identical assets held outside the Golden Triangle, which average 2-3 percentage points.

So how do we speed the flow of finance to the UK’s regions and nations and shrink regional risk premia? At root, we need to develop broad place-based portfolios of investible projects and deep pools of capital to finance them.

As recommended by the UKUF, one way of helping achieve a broad pipeline of local projects is by pooling project management expertise across the UK’s regions and nations in a central utility. Complementing that, we need a means of pooling money from different sources – public and private – effectively to finance these local portfolios at scale.

One idea for doing so would be to develop a set of Regional Wealth Funds. These would be jointly financed from public (such as the British Business Bank and UK Infrastructure Bank) and private (such as local government and private pension fund capital) sources. They would contain the local knowledge to drive down local risk premia.

The regeneration of local places, and their finances, could be further boosted by endowing them with government assets. Currently central and local government own around £1trn of non-financial assets, measured at historic cost. Rather than being sold off, as many councils are now doing of necessity, they should instead be invested in to support regeneration.

So-called Urban Wealth Funds retain assets in public ownership but draw on private sector expertise and finance to boost their value and the income stream that flow from them. They allow commercial and public objectives to be jointly pursued with the proceeds shared. They have been used successfully in the US, Sweden, the Netherlands and elsewhere.

These initiatives need to be cast in the context of a long-term, locally-agreed regeneration plan – a Local Prosperity Plan or what the Labour Party has recently called a Regional Growth Plan. This needs to embrace social and environmental, as well as economic, objectives and be designed and delivered by a broad coalition of local partners, private, public and civic.

Spatial success comes from specialisation – nurturing clusters of innovation and creativity. As the Department for Science, Innovation & Technology has recently mapped, there are many clusters of business innovation across the UK, many sited around the UK’s world-leading universities. The key to levelling-up is to curate and cultivate those clusters.

The 12 freeports and 12 investment zones recently introduced across the UK are one vehicle for doing so. These are helping shift the mindsets of local leaders, encouraging them to specialise in their business strengths and to root these in innovation and skills. That recipe, international experience tells us, creates the strongest local ladders of opportunity.

I see these ladders right across the UK, especially in places whose ladders have been lost for generations. I see it in the North-East, South Yorkshire and Merseyside. I see new narratives being crafted and latent energy being unleashed, in some cases for the first time in my lifetime. It is why I am optimistic about a national prosperity plan built from the bottom up.

The RSA is working closely with a number of places on their local prosperity plans, including by working with one of the sectors for which the UK legitimately has a place at the top table – the creative industries. For example, the RSA-initiated One Creative North initiative is about growing clusters of creative industries on a Northern pan-regional basis.

The aim is to create a Northern creative supercluster to complement, perhaps rival, the South-East. Doing so could add over £10bn annually to Northern GDP. At the Convention of the North earlier this year, the mayors from across the North committed themselves to One Creative North. Once in place, this would create the sort of spatial ladder of opportunity kicked away from many places a generation ago.

Creative corridors

Working with Creative PEC and Arts Council England the RSA is bringing together leaders across regions in the UK to grow the impact of the creative industries, and creativity in industry.

Snakes and ladders

The game of life is a game of snakes and ladders. Our era of anxiety has generated a broadly-based phobia of snakes and an acute mistrust of the ladders. Both are instinctive and understandable but both are ultimately also self-defeating. Suppressing the snakes and repairing the ladders is needed to switch us, culturally and economically, into an age of aspiration.

The RSA was born out of the Enlightenment of the 18th century, the last great age of aspiration in the West. If we are to shift to a new age of aspiration, we will need a new Enlightenment – an environment where risk and uncertainty are seen as opportunity not threat, where the culture is one of optimism not fatalism, where investment is everywhere and for everyone.

The RSA’s Design for Life mission is seeking to turn the tide of opinion and action to achieve those objectives. Opportunity and innovation have been the hallmarks of the RSA for 270 years. We are putting our money where our mouth is by investing in them now. This makes me optimistic both about the RSA and the world it is seeking to change.

Andy Haldane is the CEO of the RSA. This is an edited version of his Chief Executive’s Lecture delivered on 8 May 2024.

More blogs about our Design for Life mission

-

Inspired by nature

Blog

Rebecca Ford Alessandra Tombazzi Penny Hay

Our Playful green planet team summarises a ‘lunch and learn’ at RSA House that focused on how the influence of nature can benefit a child’s development.

-

Why social connectivity matters

Blog

Andy Haldane

Social connectivity was a theme of the 695th Lord Mayor's Lecture Series. In it, our CEO, Andy Haldane, explored the role of social capital and connectivity in nurturing health, wealth and happiness, among other things.

-

Regeneration: from time lords to transforming cities

Blog

Martin Wright

Martin Wright reports back from our sessions on the regeneration of capabilities, social infrastructure and cities at Cornwall's ‘think fest’, Anthropy 2023.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.