In our last blog 'That’s not my inflation rate!', we investigated how Headline inflation as calculated by the Bank of England doesn’t account for people living on the Breadline. Here we investigate how national statistics ignore the real costs of living for cities like Nottingham.

Nottingham recently ranked third in a national survey concerning UK house price affordability to local praise. However, someone’s ability to save for a deposit is unsurprisingly largely determined by their income and the day-to-day cost of living. An important part of how we measure this is inflation; the current rate of which we argue leaves people living in UK cities outside London with a raw deal.

Why is inflation different from place to place?

Your personal inflation is measured by a ‘representative’ basket of goods such a bread, meat, fuel, and clothes with prices quoted from across the UK. This helps make up the Headline inflation rate that we see presented in the news.

In theory, the inflation rate should be used to uprate benefits and boost incomes through wage bargaining. Many factors suggest that the residents of Nottingham are paying more and getting less compared with the UK average. This includes the freezing of benefits until 2020 – something that organisations like Joseph Roundtree Foundation are campaigning to lift – alongside decreasing density of trade union membership and stagnant local income growth.

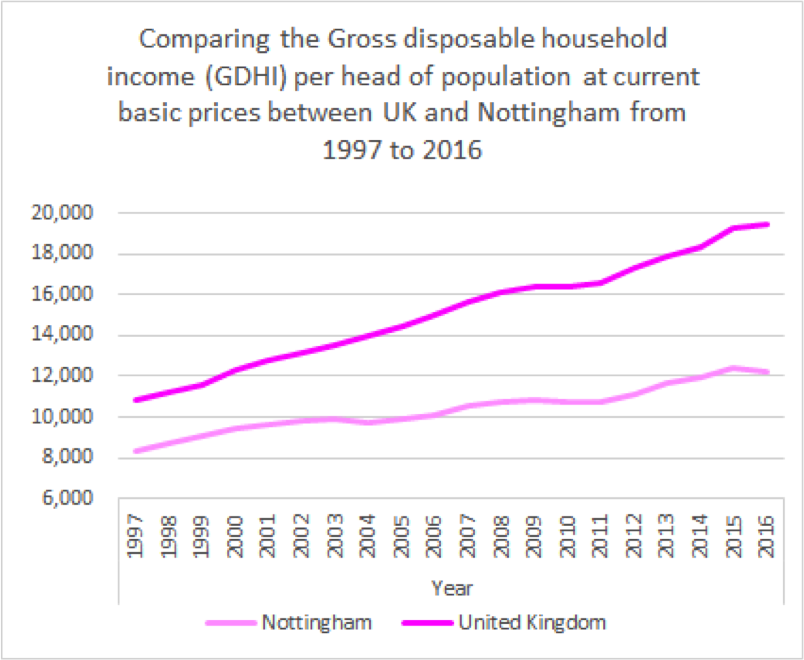

If we look at a comparison of the total amount of spare income a household has to spend or save after taxes and benefits (known as the gross disposable household income or GDHI) between Nottingham and the rest of the UK we can see that Nottingham has one of the lowest in the UK. In 2016, the GDHI for Nottingham was the lowest in the UK and it has been consistently in the bottom 5%.

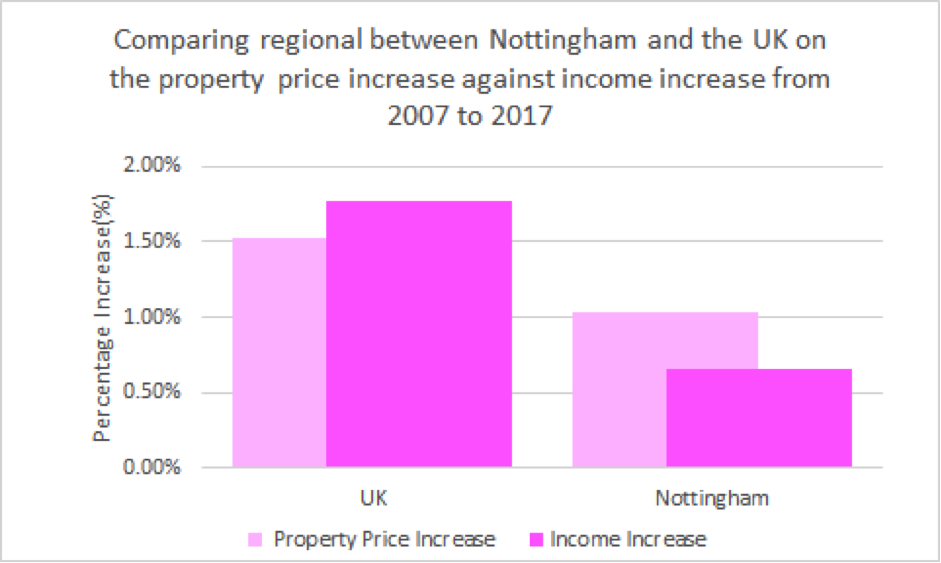

This leaves us with an important question for central government: if the disposable income of Nottingham residents is among the lowest in the UK, and local house prices are inflating faster than respective income increases, is it right that we ‘share’ an inflation rate with the rest of the UK?

While these statistics discount the most prosperous areas of Nottinghamshire (such as West Bridgford), when factoring these areas, we still achieve a GDHI figure that is £3,000 below the national average. This means, in simple terms, that people in Nottingham have £3000 less disposable income than the average person in the UK.

Indeed, despite its ‘affordable’ status, the cost of Nottingham property is increasing at double the rate of the Nottingham income whilst the medium UK income is increasing more than the average property price.

In addition to this, there has been an increase of the private rented sector (PRS) by 12% in Nottingham from 2001 to 2011 making up 32% of households whilst the UK average has been 9%. Of this 12%, two thirds complain about disrepair or poor/sub standards of their rented household. This contributes to added expenditure for things like water and heating. Indeed, the resident’s relative inflation of living accommodations in Nottingham has increased more than the average resident in the UK.

What can Nottingham do to help those on the Breadline?

Due to austerity measures, Nottingham City Council's budget has been reduced by two thirds since 2013, initially slashed by £104 million in 2014. This was in large part thanks to the introduction of the Business Rate Retention Scheme where the revenue support grant is determined by business growth rates, population, and council tax, and not through grants from central government. For a city that is already suffering increased costs with lower than national income rises, this rise in council tax to fund important services imposes a double burden on those living on the breadline.

But there are structural changes that could ease this burden. Greater Nottingham's population is 700,000, double that of the city of Nottingham. If the Nottingham City Council expanded the city’s boundaries to include less economically deprived areas such as West Bridgeford and Beeston, as well as the less affluent Hucknall, those paying higher prices for goods and services in the city could benefit.

Low-income households and vulnerable people in specific areas such as Nottingham can be lost in national statistics and end up paying more for less as essential costs rise disproportionately to that of the national average, which is not accounted for by the way the Bank of England calculates inflation.

In the coming weeks we are creating an interactive data tool that will allow people to assess how inflation affects them allowing people to more effectively 'beat' inflation while highlighting the limits one national rate of inflation.

Follow #breadlineinflation for updates on our mission to help people ‘beat’ their inflation rate

The ‘Headline to Breadline inflation’ project is a collaboration between the RSA and Nottingham Trent University that sees undergraduate students challenged to identify ways for national economic policy to effectively prevent and identify economic insecurity.

Related articles

-

No hidden charges: making pension costs transparent

Hari Mann David Pitt-Watson

Pension charges have long been hidden from customers. Hari Mann FRSA and David Pitt-Watson FRSA look back at the part the RSA has had to play in bringing about transparency and disclosure of costs.

-

Purposeful finance and the pandemic

David Pitt-Watson Hari Mann

David Pitt-Watson FRSA and Hari Mann FRSA set out why the finance industry needs to act urgently to support companies and individuals during the pandemic – and how it should build a better economy once it is over.

-

Can cash survive coronavirus?

Mark Hall

Getting your hands on money has never been so important, yet nobody wants to touch it. Mark Hall explores the urgent need for a more inclusive digital economy.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.